【代码】Financial Toolbox:Portfolio Optimization

对Matlab金融工具箱内的Portfolio_Optimization_Example代码的阅读笔记;

【Example】

打开文档

打开Matlab,在command中输入:

1 | |

可打开文档

加载数据

1 | |

初始化一个Portfolio对象

1 | |

AssetList:Asset名称的List,如果自己导入data,可采用:

1 | |

【可选步骤】

1.初始化一个 equal-weight portfolio

1 | |

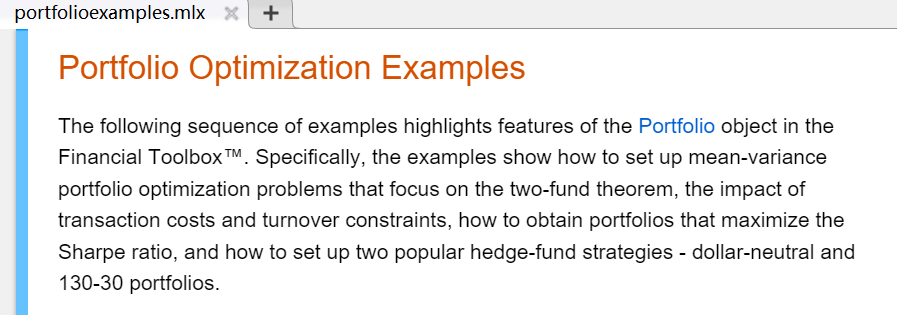

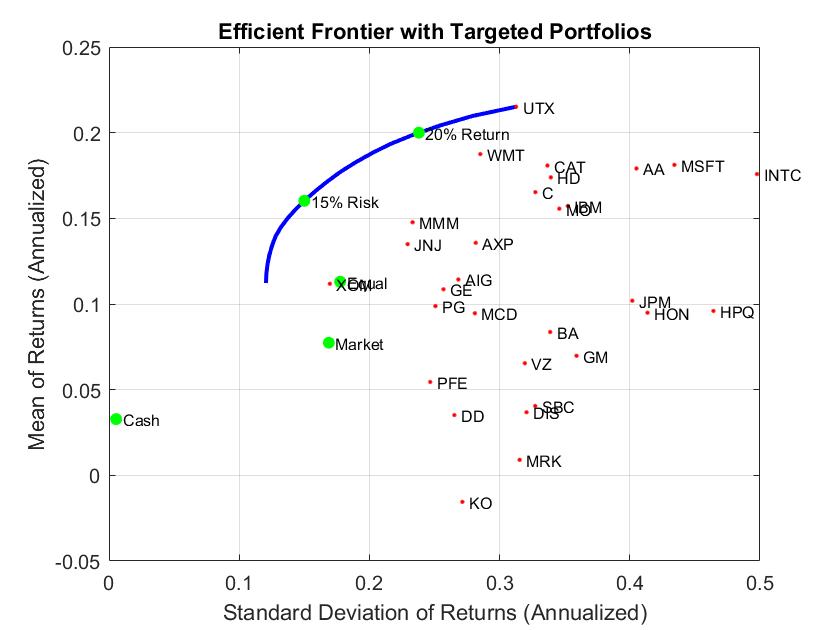

2.画一个所有Asset在risk-return上的分布图

1 | |

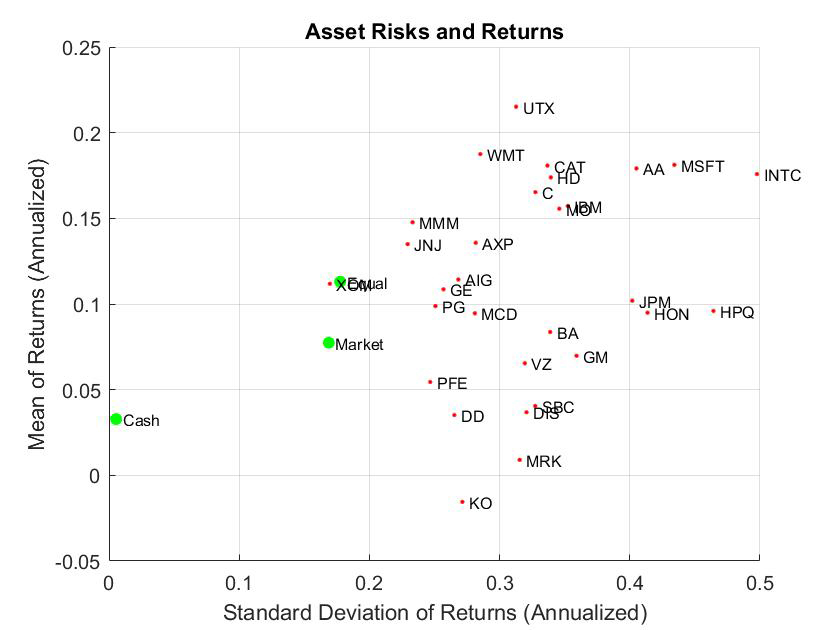

在各种约束下的投资组合优化

1.初始化一个long only portfolios

1 | |

2.初始化一个portfolios with budget constraint

1 | |

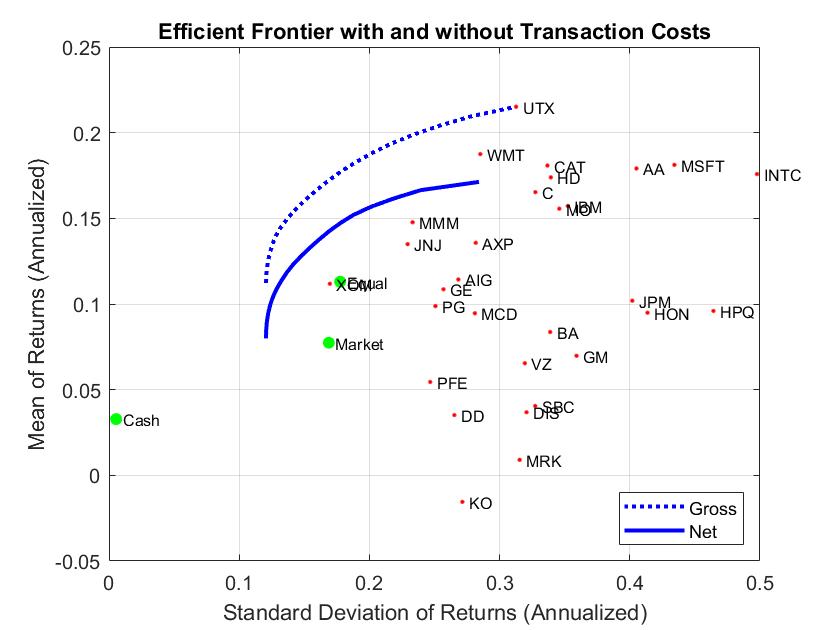

3.初始化一个portfolios其交易包含Transactions Costs

1 | |

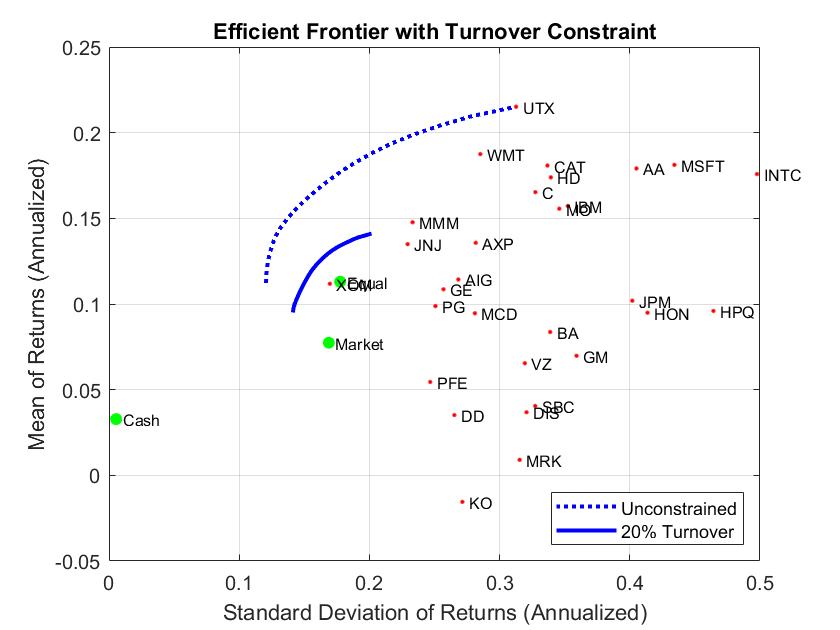

4.初始化一个portfolios其交易加入了Turnover Constraint

1 | |

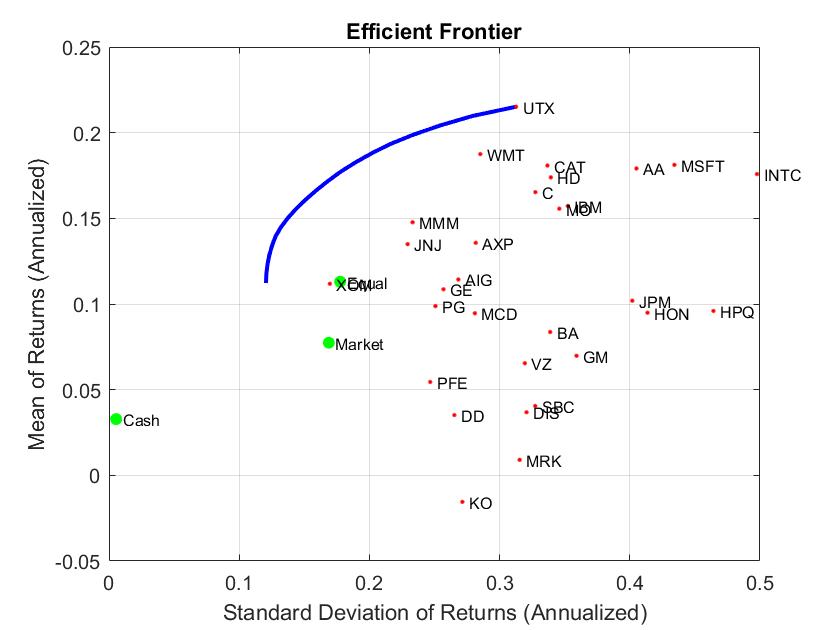

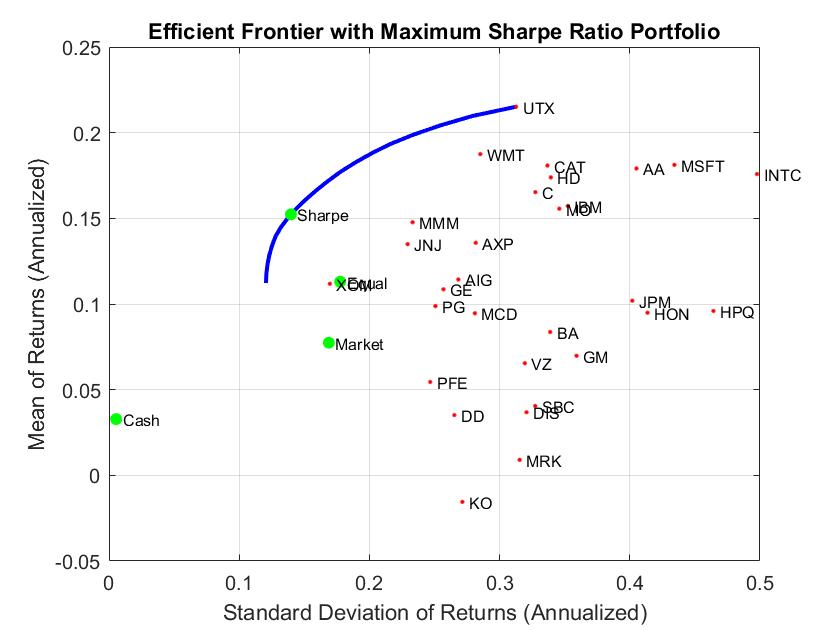

5.依照最大夏普比率得到最优组合

1 | |

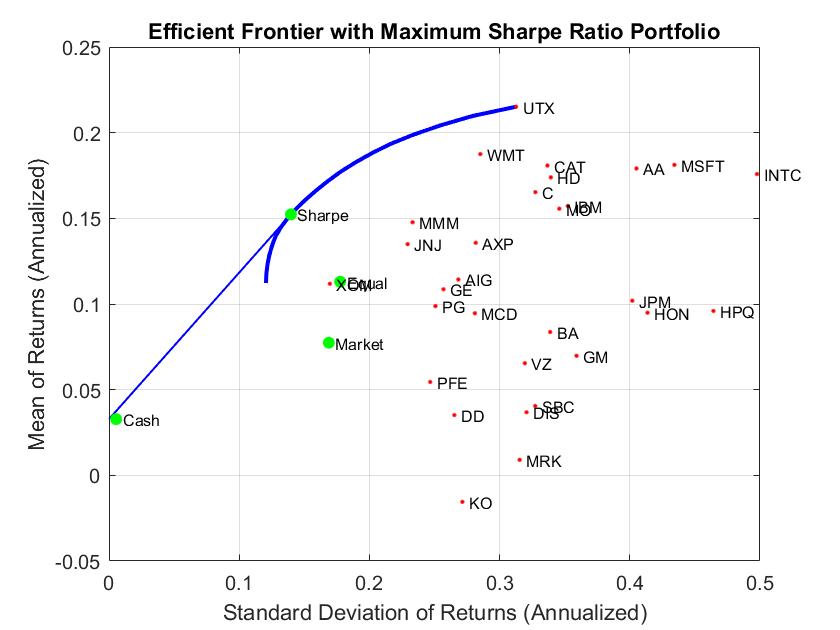

并与切线结合

1 | |

其他

1.获得risk和return的范围

1 | |

2.利用固定return或risk得到值

1 | |

3.显示portfolio的包含的Assets和weight占比

1 | |

Reference

【代码】Financial Toolbox:Portfolio Optimization

http://achlier.github.io/2021/03/11/Financial_Toolbox-Portfolio_Optimization/