【笔记】Change of Measure

基于B站up Jerry Xu 的视频《概率测度变换》系列的笔记

Section 1:Preliminary of Probability Theory

1. Probability Space

Sample Space (可能出现的结果):$\Omega$

- $\Omega=\{\omega_1,\omega_2,…\}$

- $\Omega =\omega_i, i\in I(index set)$,无限多不可数

- Random Variable $X(\omega)$定义在$\Omega$上

- $X:\Omega \to \mathbb{R}^K$

- $X^{-1}(B)=\{\omega\in\Omega:X(\omega)\in B\}\in \mathcal{F} for all$

- Borel sets:$B\in\mathscr{B}(\mathbb{R}^K)$

$\sigma$-algebra (all measurable events):$\mathcal{F}$

- $\varnothing \in \mathcal{F}$

- $A \in \mathcal{F} \Rightarrow A^C \in \mathcal{F}$

- $A_1,A_2,…\in\mathcal{F}\Rightarrow\cup_{n=1}^\infty A_n\in\mathcal{F}$

- Events are subset of $\Omega$

Probability measure (all events will be assigned a value):$\mathbb{P}$

$\mathbb{P}(\Omega)=1$

$If A_1,A_2,… are disjoint sets$

$\Rightarrow \mathbb{P}(\cup_{n=1}^\infty A_n)=\sum_{n=1}^\infty\mathbb{P}(A_n)$

$\mathbb{P}$能给$\mathcal{F}$中每一个事件都映射到闭区间0到1上,所以概率测度定义域是$\sigma$域

- $\mathbb{P}:\Omega \to [0,1]$

De Morgan’s law

2. Other Definition

期望

- Countable Infinite

- Uncountable Infinite

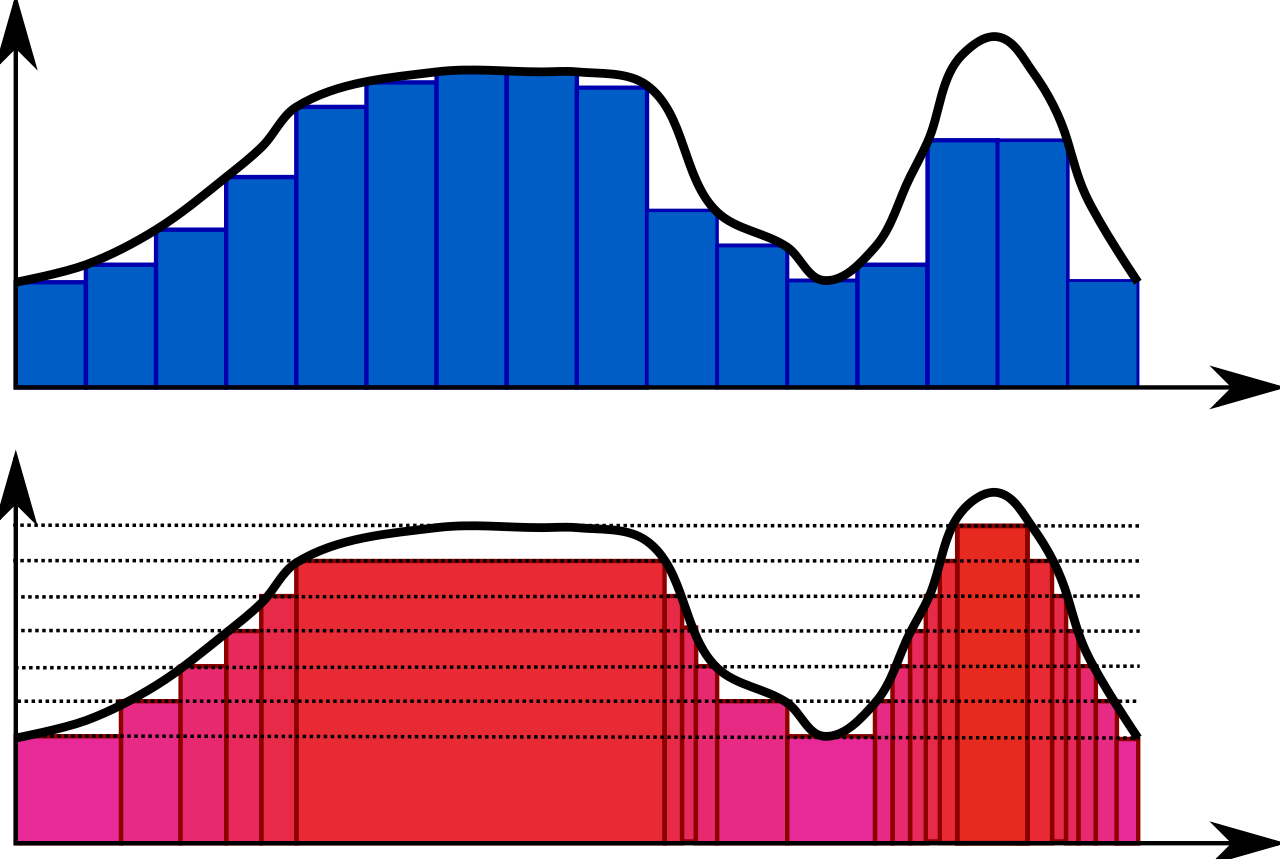

Riemann积分(upper)&Lebesgue积分(lower)

Indicator function (示性函数)

积分

For $A\subset\Omega, A\in\mathcal{F}$

For $A\subset\Omega, B\subset\Omega, A,B\in\mathcal{F}$

and $A \cap B = \varnothing$

| ($A \cap B = \varnothing$) | $\mathbb{I}_A$ | $\mathbb{I}_B$ | $\mathbb{I}_{A\cup B}$ |

|---|---|---|---|

| $A$ | 1 | 0 | 1 |

| $B$ | 0 | 1 | 1 |

| $A\cup B$ | 0 | 0 | 0 |

3. Change of Measure

测度

测度$\mathbb{P}$:真实世界测度

测度$\mathbb{Q}$:单个风险中性测度 (股票过程) 多个等价鞅测度 (债券过程)

Radon-Nikodym Derivative

Let $Z\ge 0$, with

For $A\in \mathcal{F}$, define

Then $\mathbb{Q}$ is a prob measure.

Furtheremore, if $X\ge 0$, then

if $Z> 0$, then

4. Example

Question:we have $X(\omega)=\omega\sim N^\mathbb{P}(0,1)$ . Set $Y(\omega)=X(\omega)+\theta (\theta>0)$ . So it follow $N^\mathbb{P}(\theta,1)$ . Build a Probability measure $\mathbb{Q}$ and make $Y$ follow $N^\mathbb{Q}(0,1)$ . Find the Radon-Nikodym Derivative.

Recall that the PDF and CDF of Standard normal distribution:

CDF

Under $\mathbb{P}: X\sim N^\mathbb{P}(0,1)$, we have:

Under $\mathbb{Q}: Y\sim N^\mathbb{Q}(0,1)$, we have:

Set $l\to l+\theta$

Solving the function

so

在随机变量中 $Z(\omega)$ 为 exponential martingale (指数鞅)

真实世界中

风险中性世界中

Section 2:Girsanov’s Theorem

1. Conditional Expection

$\mathscr{G}$ is a sub-$\sigma$-algebra of $\mathcal{F}$. $X$ is a nonnegative & integrable r.v. The conditiond expextation of $X$ given $\mathscr{G}$, denoted $\mathbb{E}[X|\mathscr{G}]$, is any r.v. that satisfies:

- $\mathbb{E}[X|\mathscr{G}]$ is $\mathscr{G}$-measurable

- $\int_A \mathbb{E}[X|\mathscr{G}]d\mathbb{P}(\omega)=\int_AX(\omega)d\mathbb{P}(\omega), for \forall A\in\mathscr{G}$ : Partical Averaging

Properties

Pull out property: If $X$ is a $\mathscr{G}$-measureable, then

Tower property (or Iteration): If $\mathcal{H}$ is a sub-$\sigma$-algebra of $\mathscr{G}$

Radon-Nikodym Derivative Process

$Z(t)$ is a martingale ($ 0\leq s\leq t\leq T$)

$Z(t)$ is Radon-Nikodym Derivative ($Y$ is $\mathcal{F}(t)$-measureable)

$\mathbb{Q}^\mathbb{P}[Y|\mathcal{F}(s)]=\frac{1}{Z(s)}\mathbb{E}^\mathbb{P}[YZ(t)|\mathcal{F}(s)]$ (Right hand side is the conditiond expextation of $Y$)

- $\frac{1}{Z(s)}\mathbb{E}^\mathbb{P}[YZ(t)|\mathcal{F}(s)]$ is $\mathcal{F}(s)$-measureable

- For any $A \in \mathcal{F}(s)$, we have $\int_AY(\omega)d\mathbb{Q}(\omega)=\int_A \frac{1}{Z(s)}\mathbb{E}^\mathbb{P}[YZ(t)|\mathcal{F}(s)]d\mathbb{Q}(\omega)$

levy’s theorem:Let $M(t)$, $t\ge 0$, be a martingale, relative to$\mathcal{F}(t)$, $t\ge 0$. Assume $M(0)=0$, $M(T)$ has contiunous paths and quadratic variation = t ( 二次变差 ) for all $t\ge 0$. $\Rightarrow M(t)$ is a Brownian Motion.

当 $\{t_i^n\}_{i=0}^n$ 遍取 $[0,t]$ 的分割,其模 $\delta_n=max_{0\leq i\leq n-1}\{t_{i+1}^n-t_i^n\}\to 0$时,依概率收敛意义下的极限

BM 只有 $dW(t)dW(t)=dt$ 会在一单位时间内积累一单位二次变差. $dtdt=dtdW(t)=0$

2. Girsanov

Let $W(t)$ be a BM on $(\Omega,\mathcal{F},\mathbb{P})$ and let $\mathcal{F}(t)$ be a filtration. For this BM, let $\Theta(t)$ be an adopted process. Define

or

Set $Z=Z(T)$. Then $\mathbb{E}Z=1$, $Z\ge 0$

Where $\mathbb{Q}$ given by

The process $\tilde{W}(t)$ is a BM

Prove

$\mathbb{E}Z=1$

Set

$\Rightarrow Z(t)$ is a $\mathbb{P}$-martingale

$\tilde{W}(t)Z(t)$ is a martingale

$\Rightarrow \tilde{W}(t)Z(t)$ is a $\mathbb{P}$-martingale

$\tilde{W}(t)$ is a martingale $\mathbb{E}^\mathbb{Q}[\tilde{W}(t)|\mathcal{F(s)}]=\tilde{W}(s)$

$\Rightarrow \tilde{W}(t)$ is a $\mathbb{Q}$-martingale

$\tilde{W}(0)=W(0)+\int_0^0\Theta(s)ds=0$

The both parts of $\tilde{W}(t)$ has contiunous paths.

$d\tilde{W}(t)=dW(t)+\Theta(t)dt$, where $dtdt=0$ accumulated zero quadratic variation.

$[3-6]\Rightarrow \tilde{W}(t)$ is a BM