【笔记】Financial_Mathematics

基于 ChiuFai WONG 教授的FM课件进行的零碎知识的整理;

Chapter 1 Annuities

$i_t=\frac{a(t)-a(t-1)}{a(t-1)}$ , $d_t=\frac{a(t)-a(t-1)}{a(t)}$

$a(t)=(1+i)^t$ compound interest accumulation function

$a(t)=(1-d)^{-t}$ compound discount accumulation function

$1-d=v=\frac1{1+i}$

$i^{(m)}$ nominal rate of interest compounded m times a year

$(1+\frac{i^{(m)}}m)^m=1+i$ , $i^{(m)}=m((1+i)^{1/m}-1)$

$d^{(m)}$ nominal rate of discount compounded m times a year

$(1-\frac{d^{(m)}}m)^m=1-d$ , $d^{(m)}=m(1-(1-d)^{1/m})$

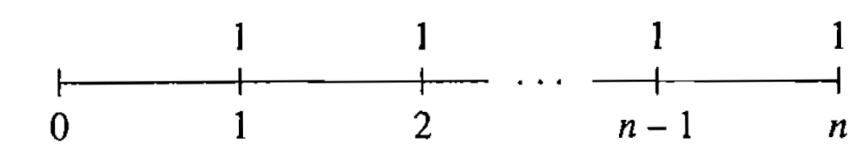

$a_{_n\bigg\urcorner_i}=\frac{1-v^{n}}{i}$ annuity-immediate

$S_{_n\bigg\urcorner_i}=(1+i)^na_{_n\bigg\urcorner_i}=\frac{(1+i)^n-1}{i}$

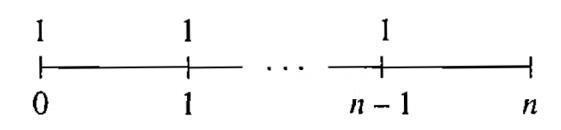

$\ddot a_{_n\bigg\urcorner_i}=\frac{1-v^{n}}{d}$ annuity-due , $\ddot a_{_n\bigg\urcorner_i}=(1+i)a_{_n\bigg\urcorner_i}=1+a_{_{n-1}\bigg\urcorner_i}$

$\ddot S_{_n\bigg\urcorner_i}=\frac{(1+i)^n-1}{d}$ , $S_{_n\bigg\urcorner_i}=(1+i)^{-1}\ddot S_{_n\bigg\urcorner_i}=1+\ddot S_{_{n-1}\bigg\urcorner_i}$

$a_{_\infty\bigg\urcorner_i}=\frac{1}{i}$ perpetuity-due

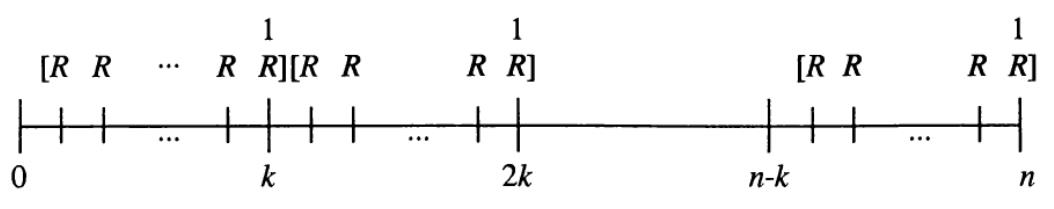

$\frac{a_{_n\bigg\urcorner_i}}{S_{_k\bigg\urcorner_i}}$ pays 1 at the end of each k interest periods for a total of n interest periods

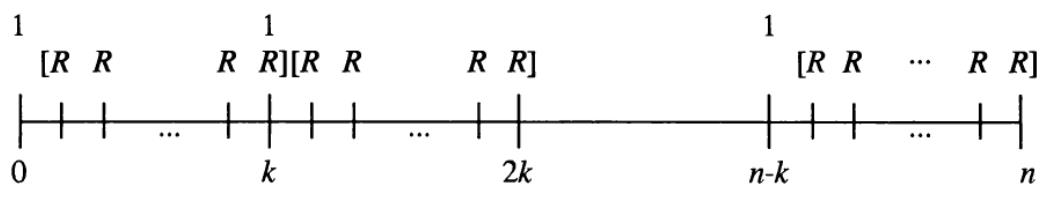

pays 1 at the beginning of each k interest periods for a total of n interest periods

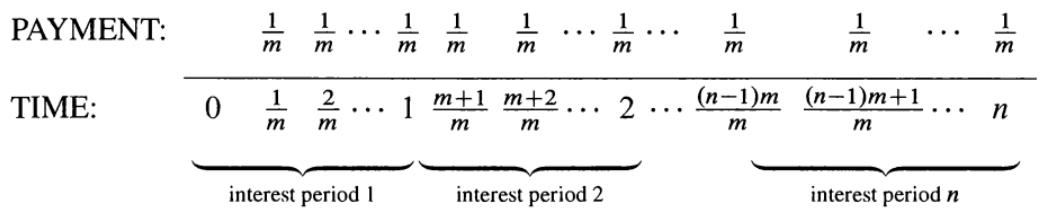

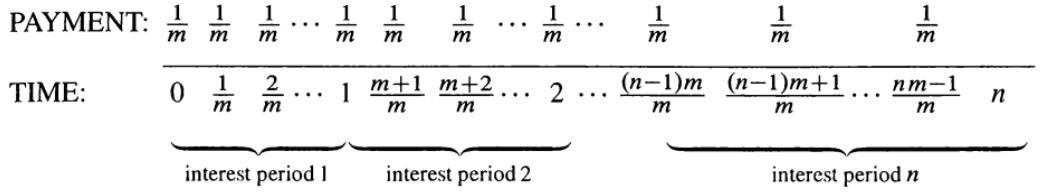

$a_{_n\bigg\urcorner_i}^{(m)}=\frac{1-v^n}{i^{(m)}}$ pays 1/m at the end of each m-th of an interest period for a total of n interest periods

$S_{_n\bigg\urcorner_i}^{(m)}=\frac{(1+i)^n-1}{i^{(m)}}$

$\ddot a_{_n\bigg\urcorner_i}^{(m)}=\frac{1-v^n}{d^{(m)}}$ pays 1 m at the end of each m-th of an interest period for a total of n interest periods

$S_{_n\bigg\urcorner_i}^{(m)}=\frac{(1+i)^n-1}{d^{(m)}}$

Chapter 2 Forwards and Futures

Chapter 3 Options

- $\Delta=\frac{f_{u}-f_{d}}{S(0) u-S(0) d}$

- $p=\frac{e^{(r-\delta) T}-d}{u-d}$ (on the futures $p=\frac{1-d}{u-d}$)

- $f=e^{-r T}\left(p f_{u}+(1-p) f_{d}\right)$ expected future payoff in a risk-neutral world discounted at the risk-free rate

Cox-Ross-Rubinstein Formula

In order to match the stock price volatility with the tree’s parameters, we must therefore have

where

Black-Scholes Formula

where

Put-Call parity

For put futures option

The put-call parity result for currency options (in domestic HK dollars) is

$C_d(x(0),K,T)$ purchase 1 foreign currency(US dollars) for K domestic currency

Exchange option

or

Early exercise of American call option

The put option must be worth at least 0. Early exercise will not be rational if $PV_{t,T}(Div)<K(1-e^{-r(T-t)})$ , because $C_{Amer}\ge(S(t)-K)$

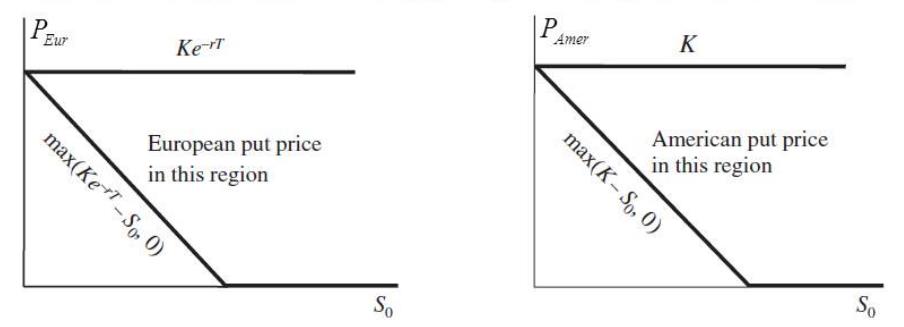

The bounds for European and American put option on a non-dividend-paying stock

Chapter 4 Black-Scholes Equations

Let $X_i$, either $\sqrt{t/n}$ or $-\sqrt{t/n}$, $Z_n=\sum_{i=1}^nX_i$

The quadratic variation of the random walk is defined by

If the time steps go to zero , $Z(t)$ is called Brownian motion

Let $S(t)$ be stock price at time t

Let us analyze a portfolio $W$

Hence

with $\delta_s$ and $\delta_w$ be the continuous dividend rates of the stock and the portfolio

Sharpe ratio

If $c_1S_1(t)+c_2S_2(t)$ is a risk free portfolio with risk-free interest rate $r$

with $c_1\sigma_1S_1(t)\pm c_2\sigma_2S_2(t)=0$

Black-Scholes for currency

Black-Scholes for options on Future

Black-Scholes PDE for options on Future

Chapter 5 Greek Symbol and Hedging

Black-Scholes partial differential equation

gives us the relation between Greek symbols

A better approximation of the change on option value

set $\varepsilon=S(t+h)-S(t)$ , $x_0=S(t)$ , $x=S(t+h)$ , $f(x_0)=V(S(t))$ , $f’(x_0)=\Delta$ , $f’’(x_0)=\Gamma$ , error term $=\theta h$

Consider a delta-neutral portfolio

The market-maker makes

Assume a delta hedged portfolio consists of selling (or buying) an option $V(0)$, buying $\Delta$ shares of stock $S(0)$, and borrowing the money needed for the other two transactions $\Delta S(0)-V(0)$.

If we approximate $e^{rh}-1$ as $rh$