【笔记】财务管理笔记

基于《Essentials of Financial Management 》课堂要点整理笔记,主要用于查询公式。

目录

- Lecture1-chp 01 02

- Lecture2-chp 04

- Data of D’Leon

- Ratios

- Liquidity

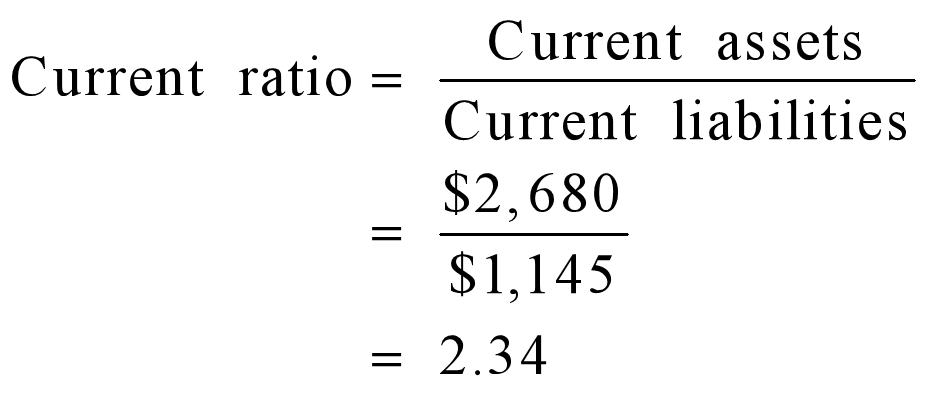

- Curr ratio

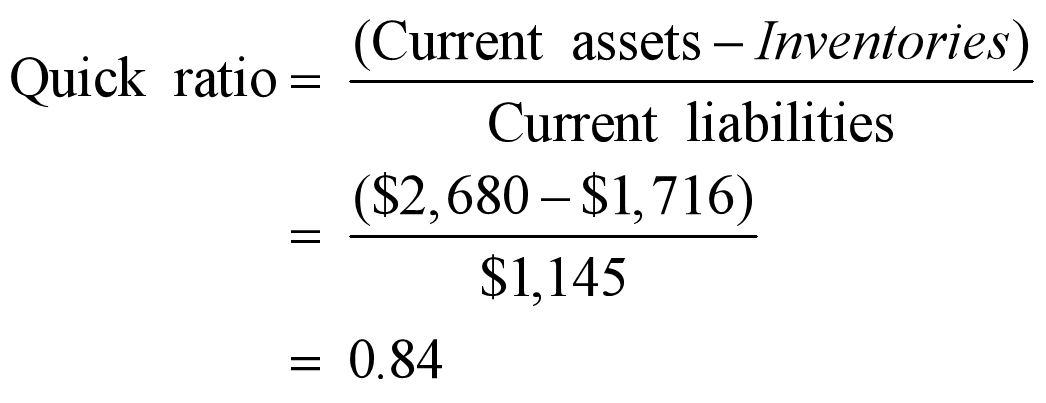

- Quick ratio

- Asset management

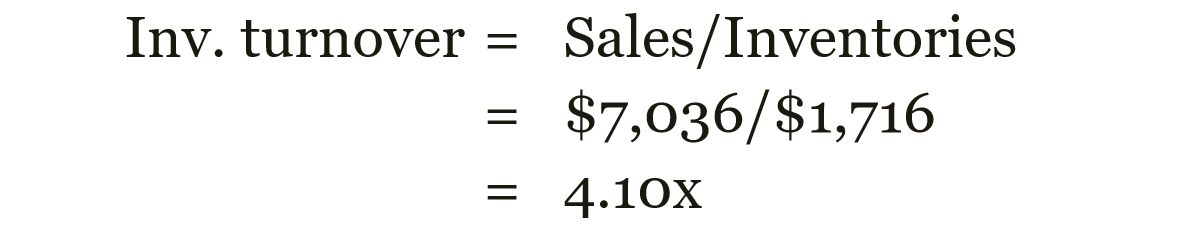

- Inv.turn

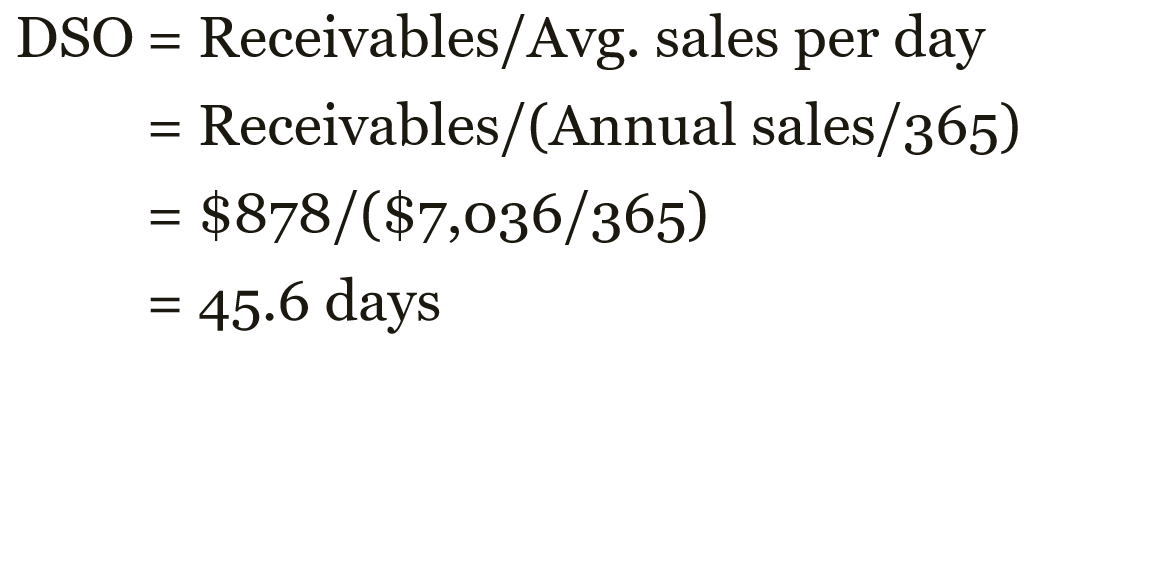

- DSO

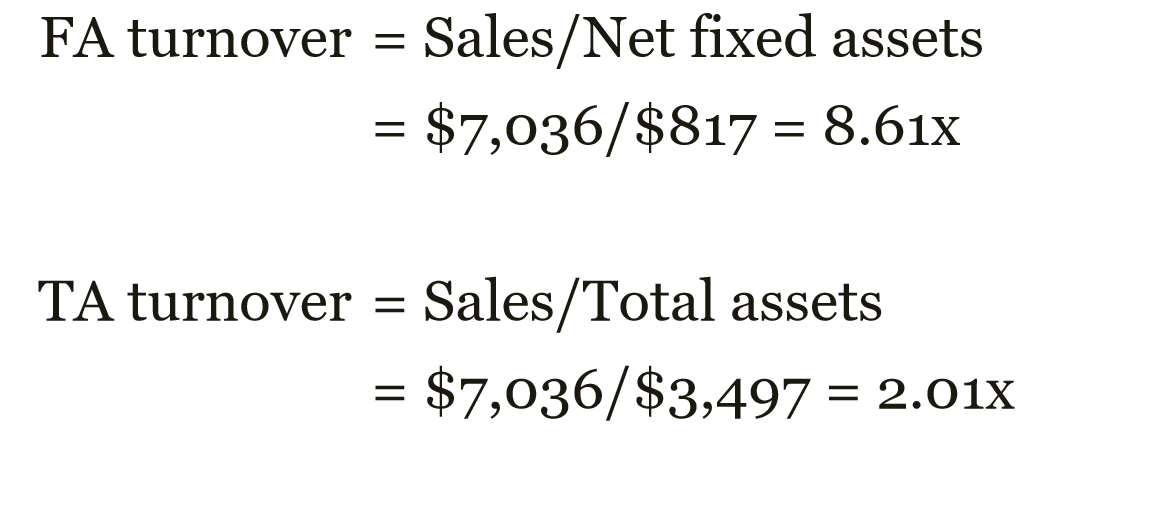

- FA.turn

- Debt management

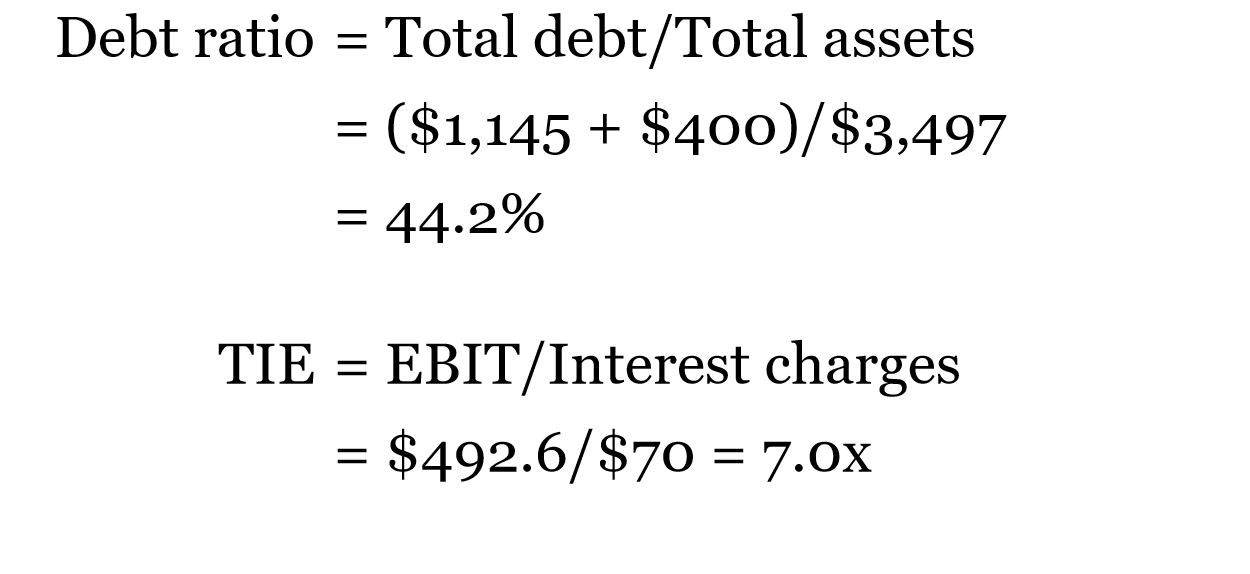

- Debt ration

- TIE

- Profitability

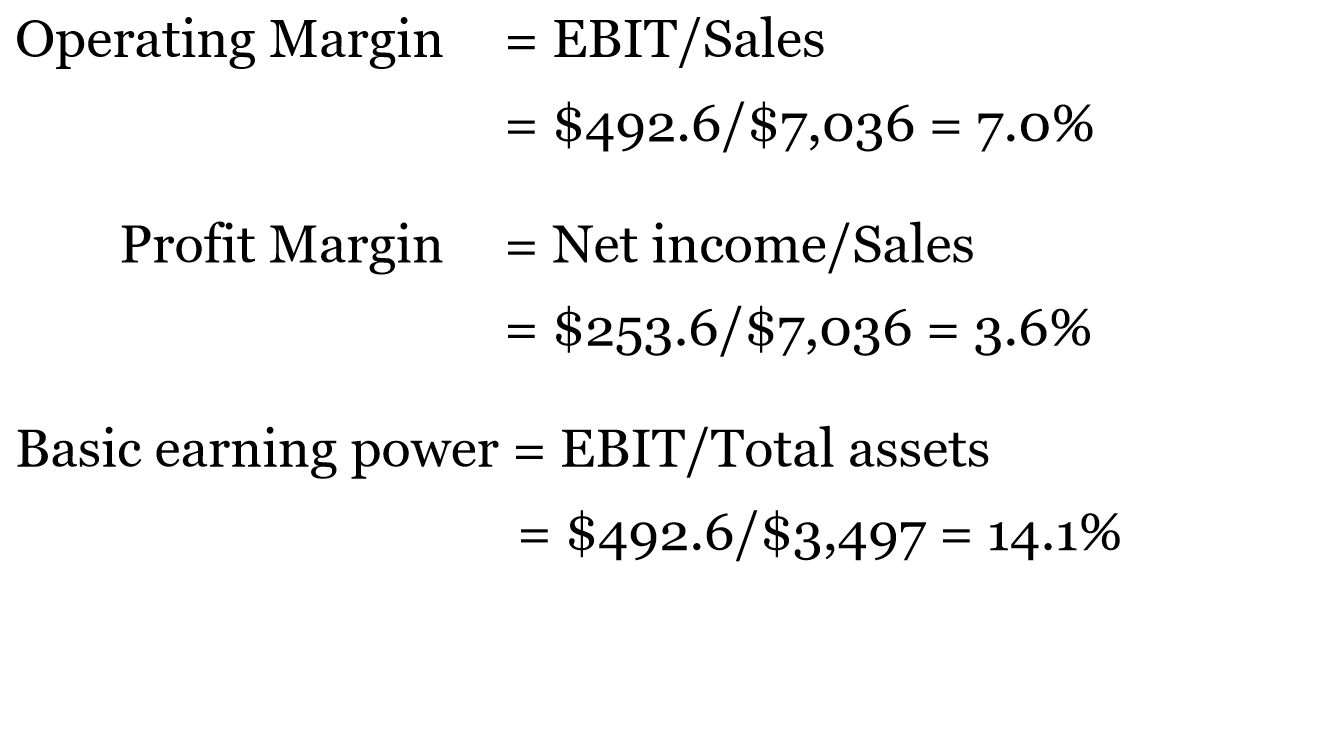

- Operating Margin

- Profit Margin

- Basic earning power

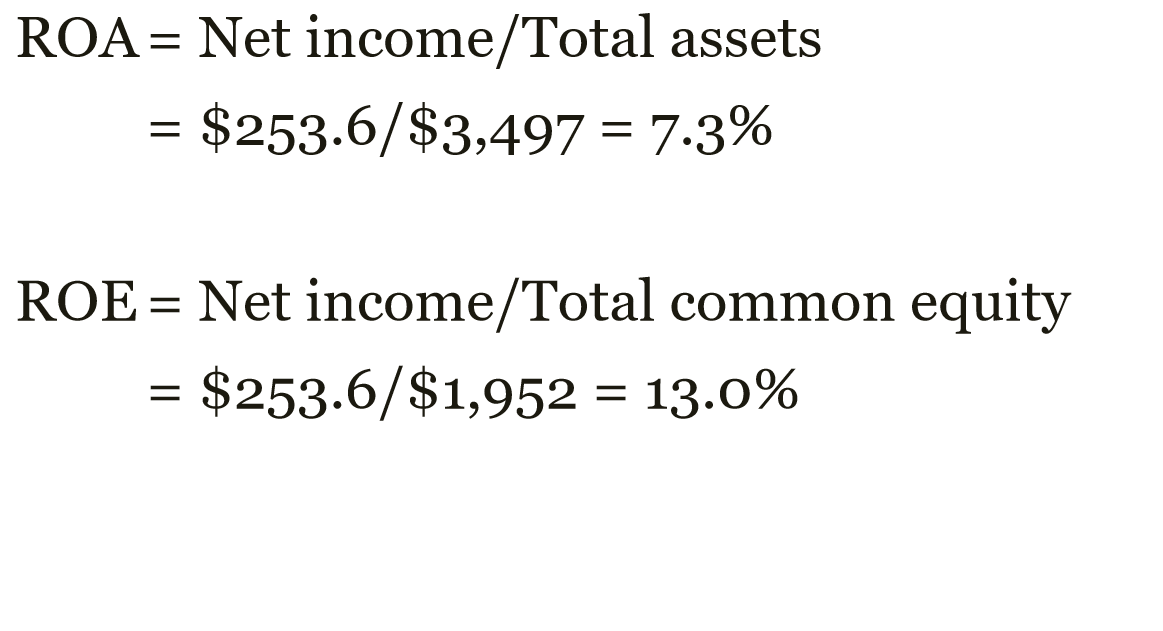

- ROA

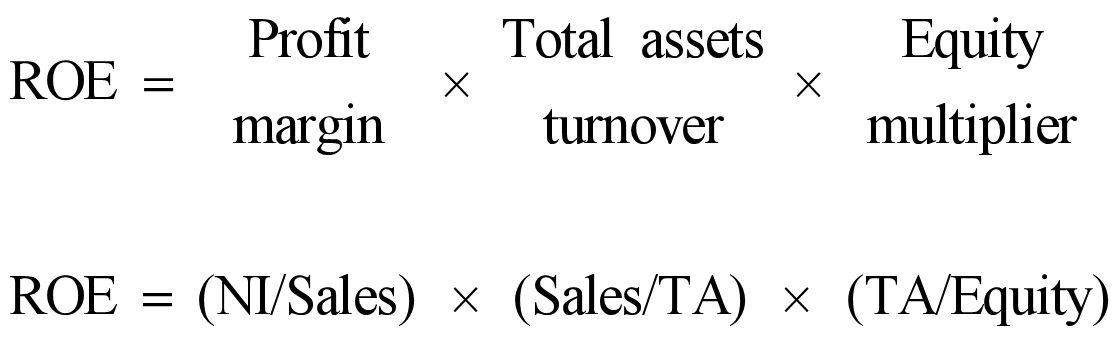

- ROE

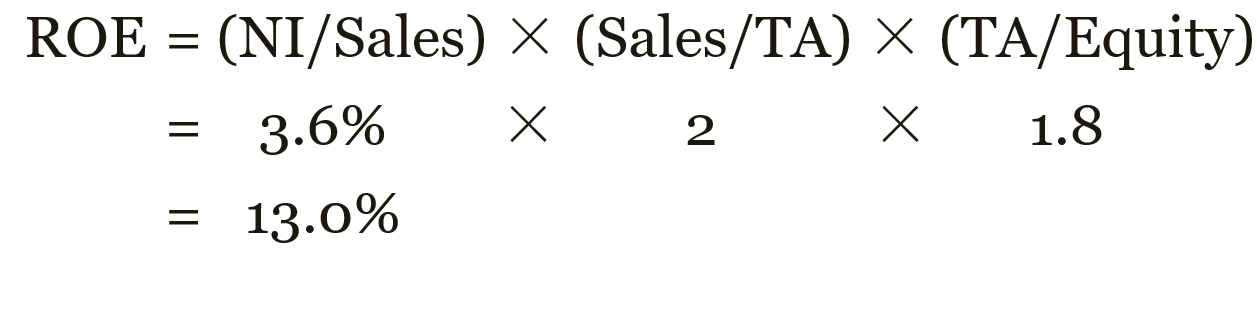

- Book value per share

- Market value

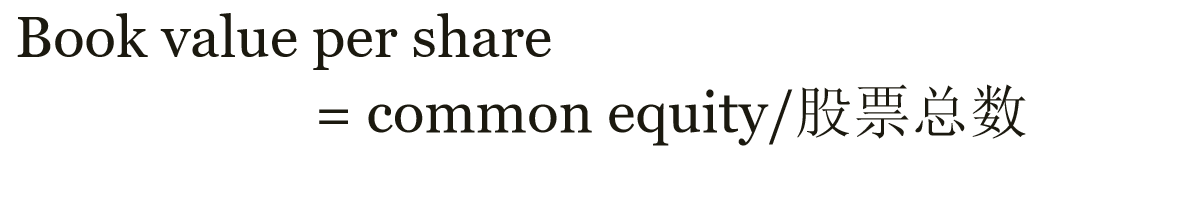

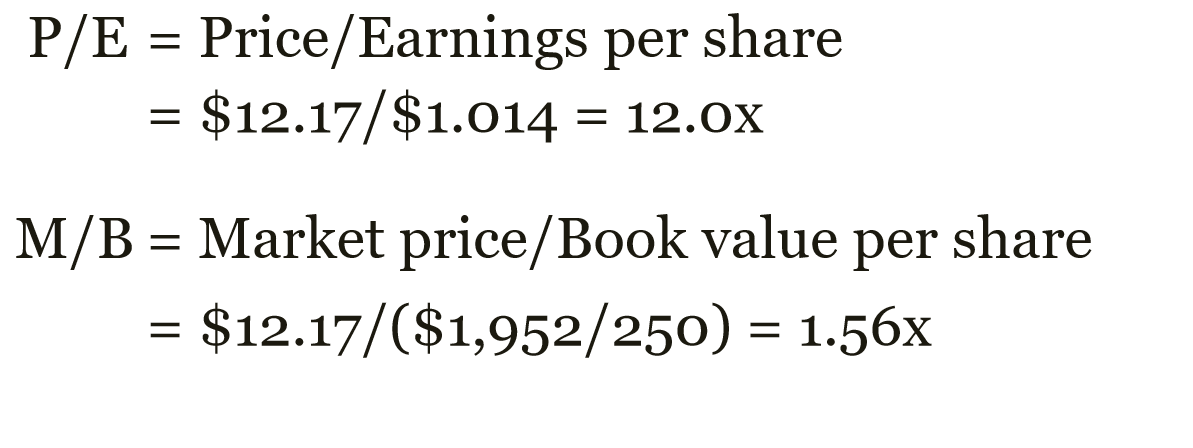

- P/E

- M/B

- Liquidity

- Lecture3-chp 05

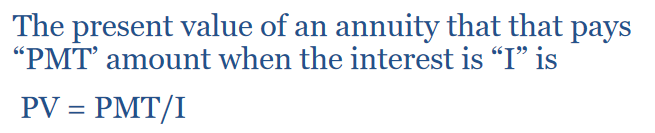

- Perpetuity and its Present Value

- PV

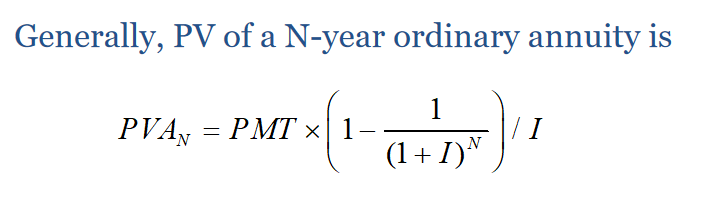

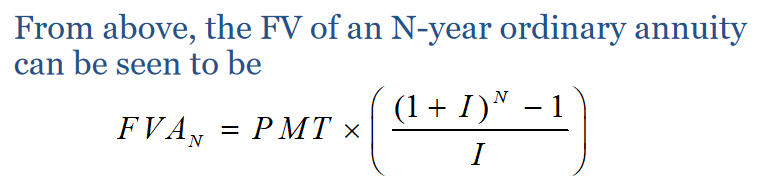

- PV of a N-year ordinary annuity

- Others

- Loan Amortization

- Perpetuity and its Present Value

- Lecture4-chp 07 09

- Lecture5-chp 10

- Lecture6-chp 08

- Lecture7-chp 11

- Lecture8-chp 12

- Lecture9-chp 13

- Relevant Cash Flows

- Initial

- Anual

- End

- Three Types Risk

- Scenario Analysis

- Relevant Cash Flows

- Lecture10-chp17

Lecture1-chp 01 02

Proprietorships and Partnerships

- Advantages

- Ease of formation

- Subject to few regulations

- No corporate income taxes

- Disadvantages

- Difficult to raise capital

- Unlimited liability

- Limited life

Corporation

- Advantages

- Unlimited life

- Easy transfer of ownership

- Limited liability

- Ease of raising capital

- Disadvantages

- Double taxation

- Cost of setup and report filing

Lecture2-chp 04

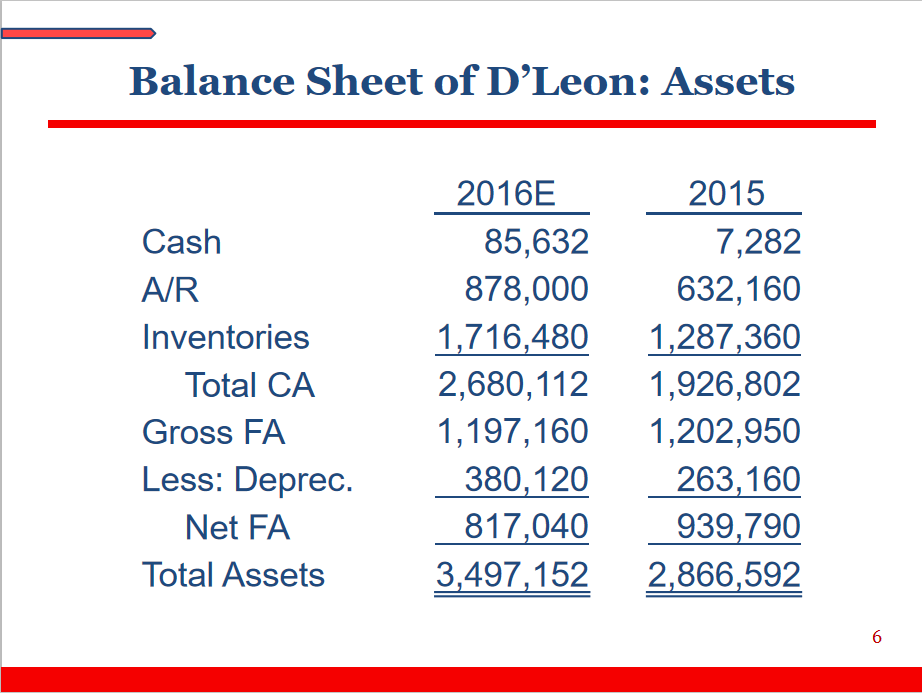

Balance Sheet of D’Leon: Assets

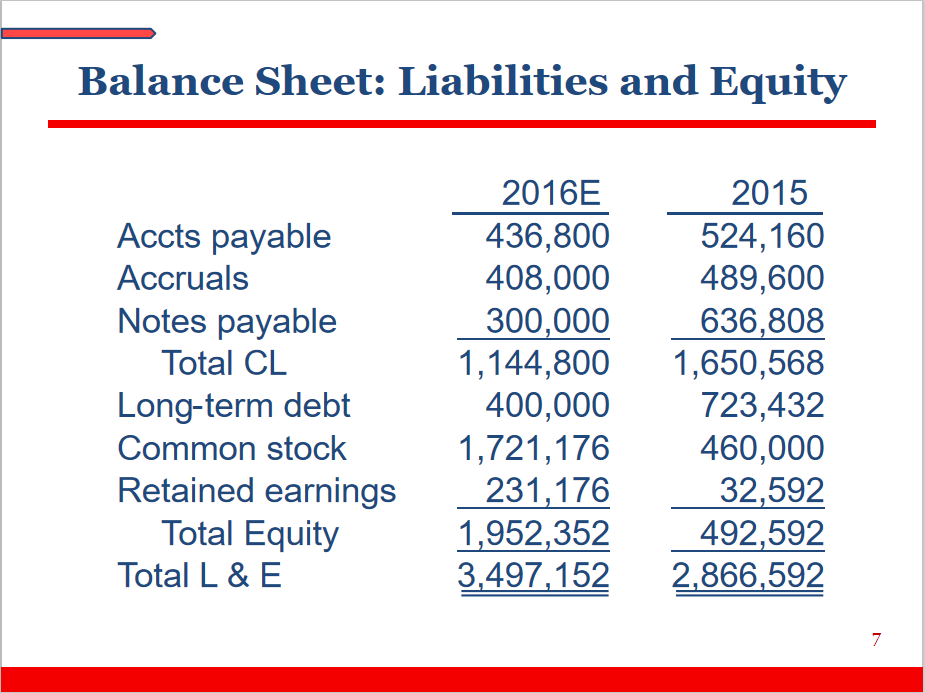

Balance Sheet: Liabilities and Equity

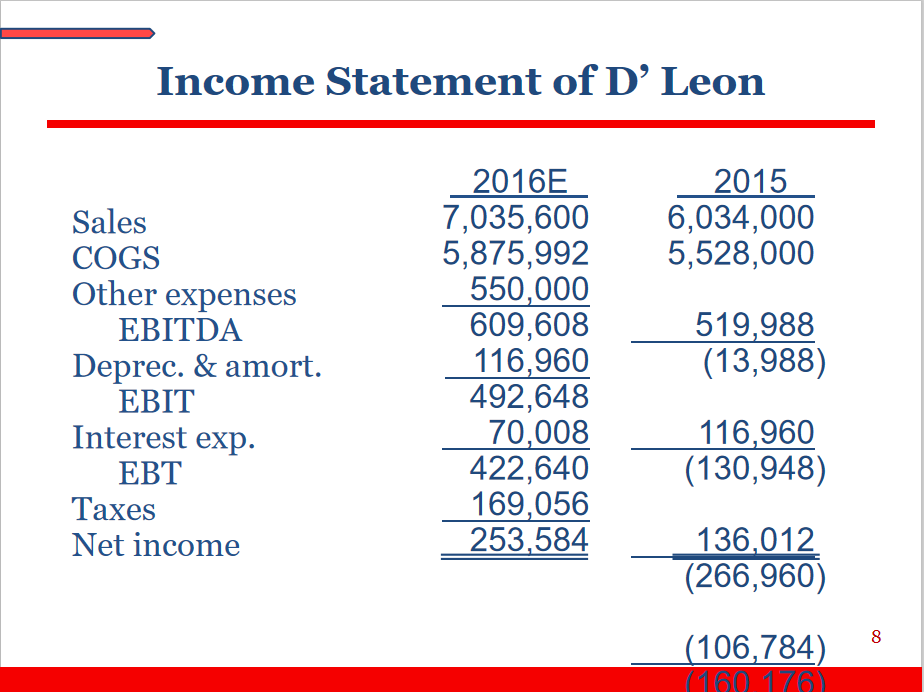

Income Statement of D’ Leon

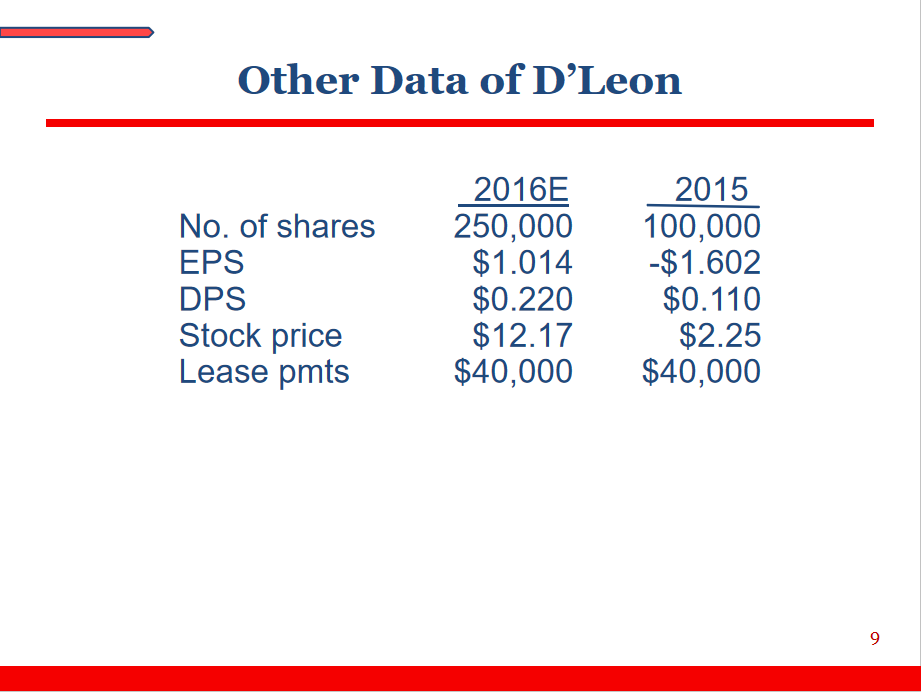

Other Data of D’Leon

Ratios

Liquidity

Asset management

Debt management

Profitability

Market value

Lecture3-chp 05

Perpetuity and its Present Value

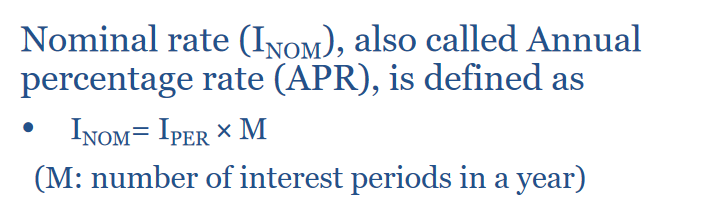

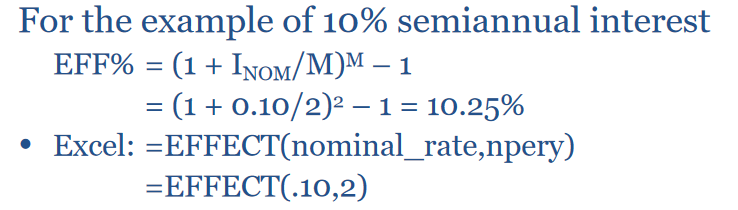

Others

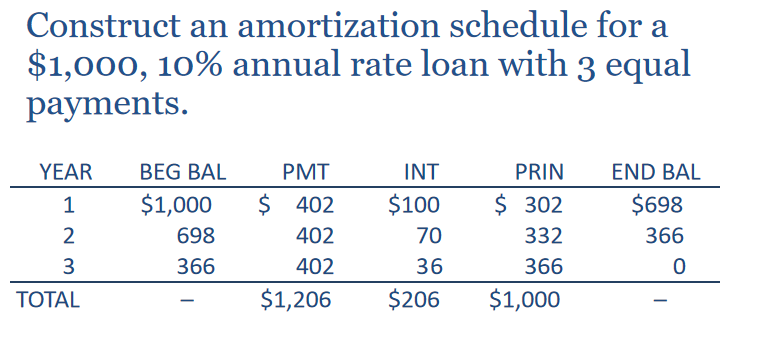

Loan Amortization

Lecture4-chp 09 07

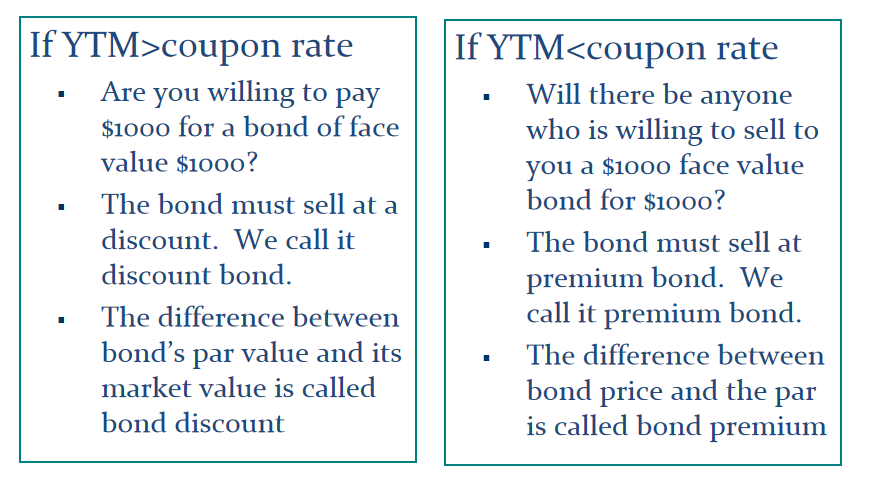

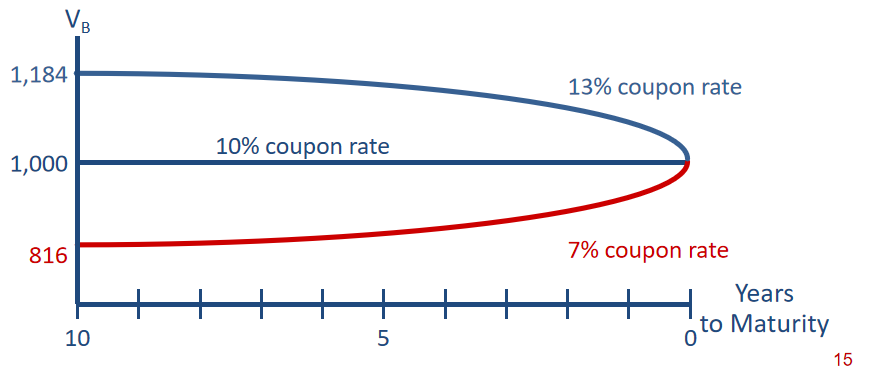

Discount bond and Premium bond

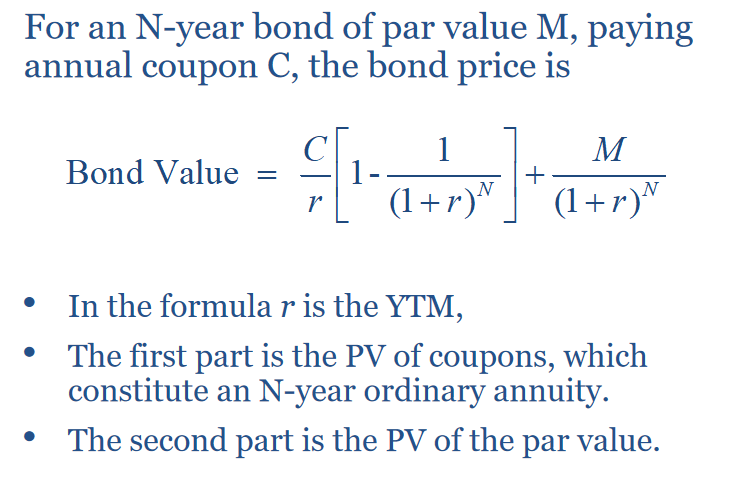

Bond Valuation

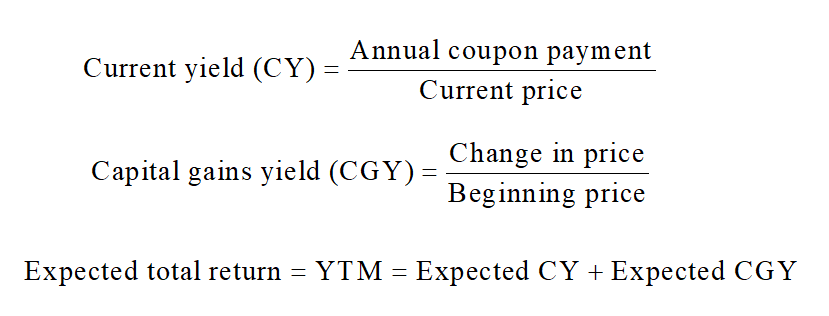

Current yield (CY) and the Capital gains yield (CGY)

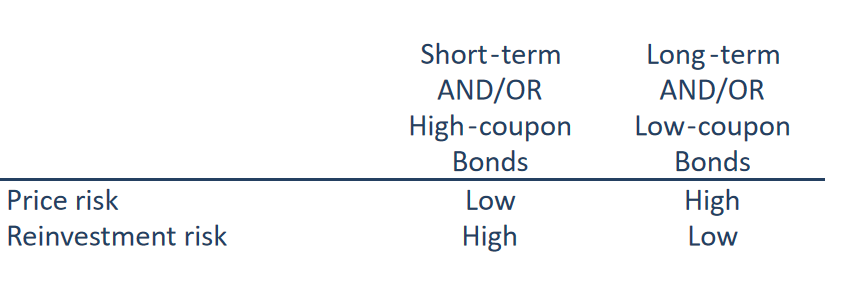

Price Risk and Reinvestment Risk

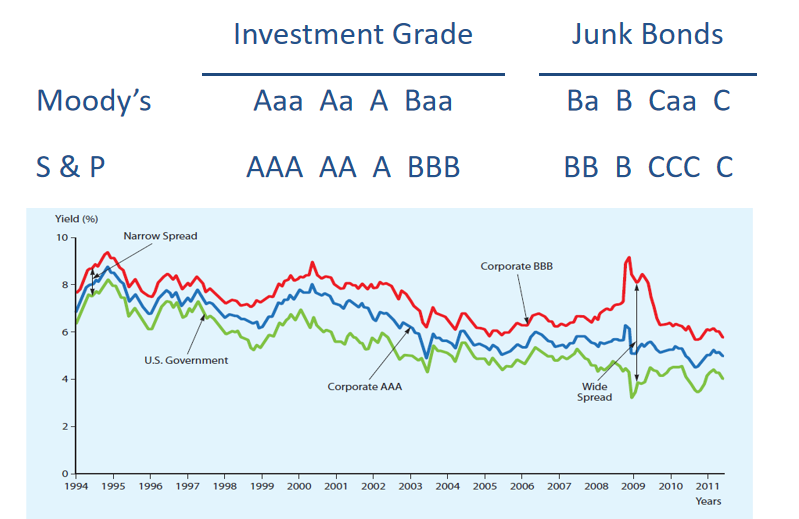

Bond Rating

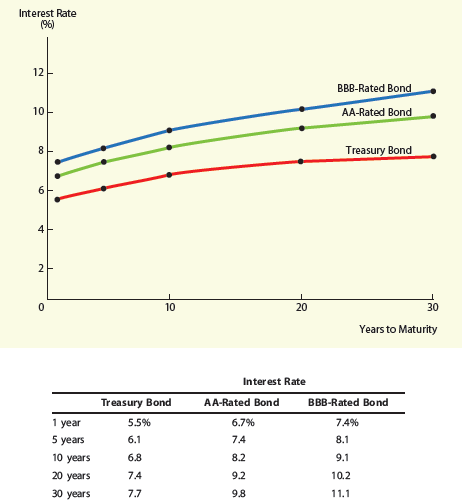

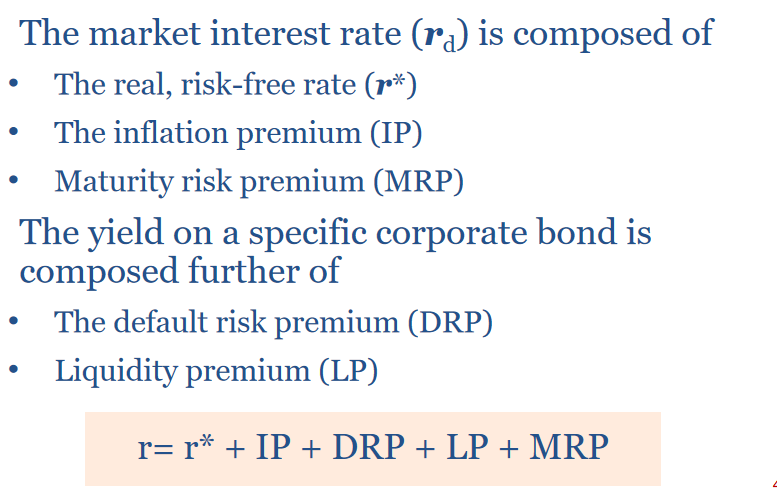

Eterminants of Interest Rate

Lecture5-chp 10

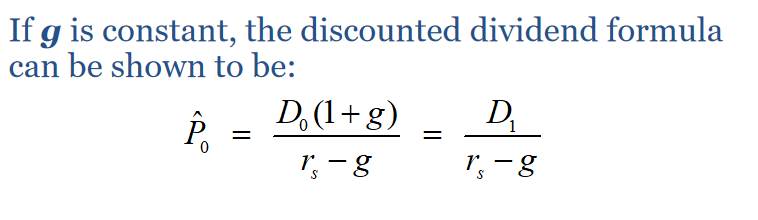

Constant Growth Stock

- The constant growth model can only be used if: rs > g, and g is expected to be constant forever.

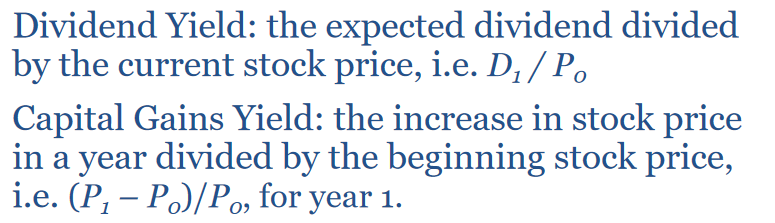

Dividend Yield and Capital Gains Yield

- Expected Total Return = Dividend Yield + Capital Gains Yield

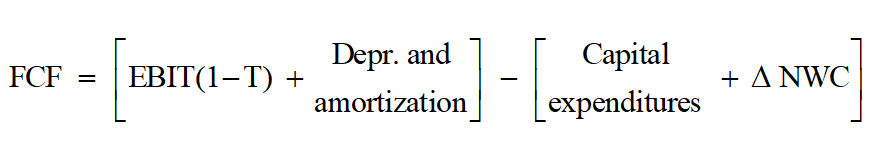

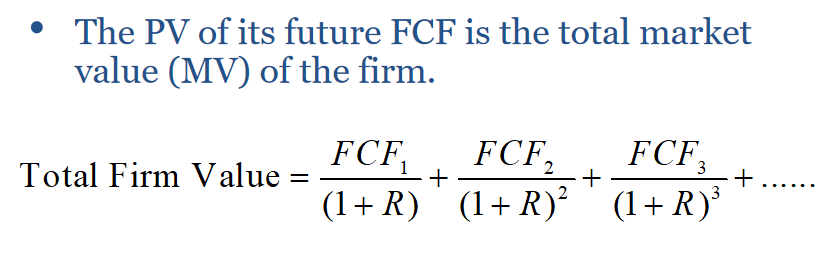

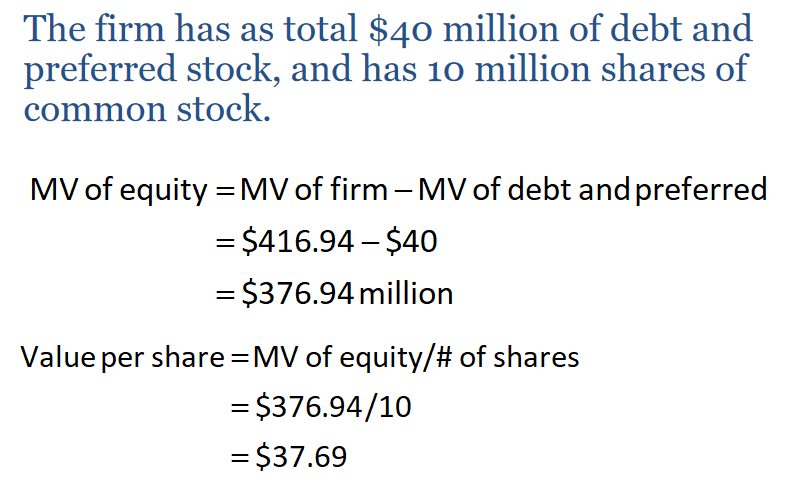

Stock valuation based on Free Cash Flow FCF

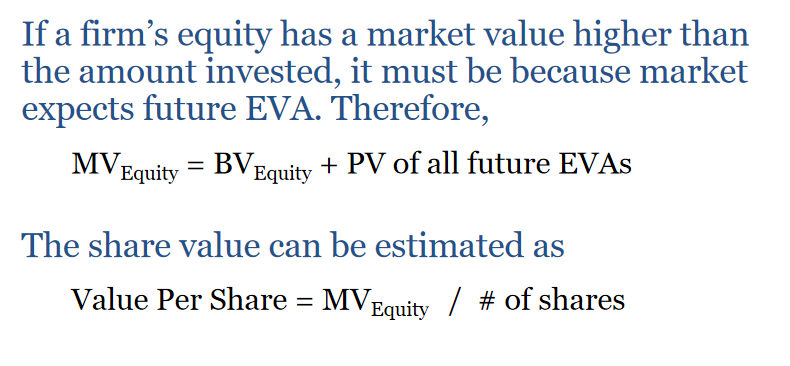

Find the Firm’s Intrinsic Value

Other Approaches to Stock Valuation

Lecture6-chp 08

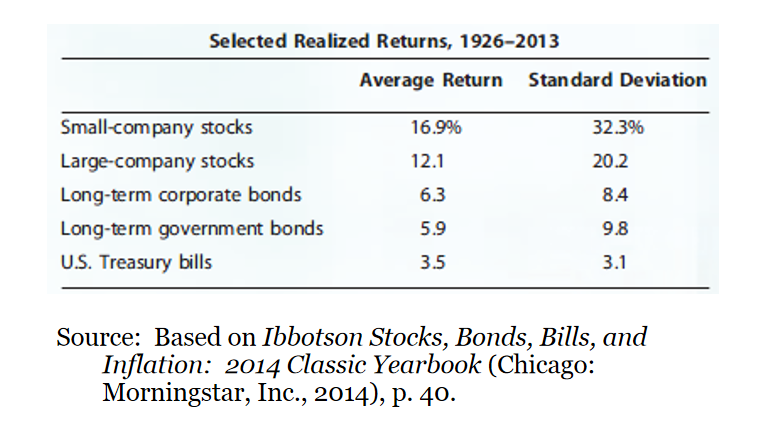

Selected Realized Returns

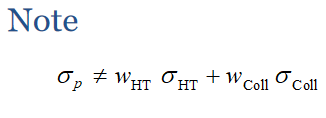

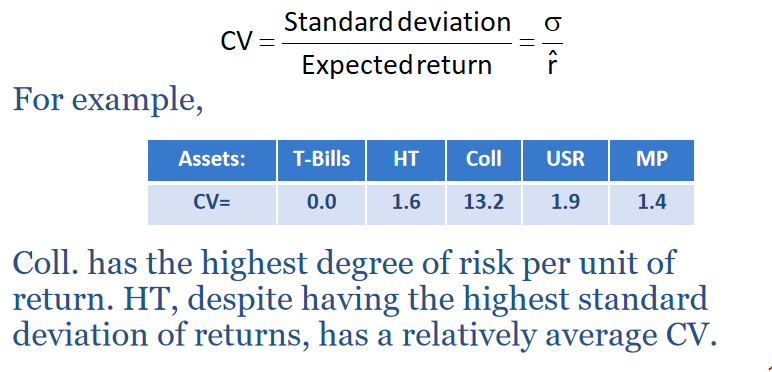

Coefficient of Variation

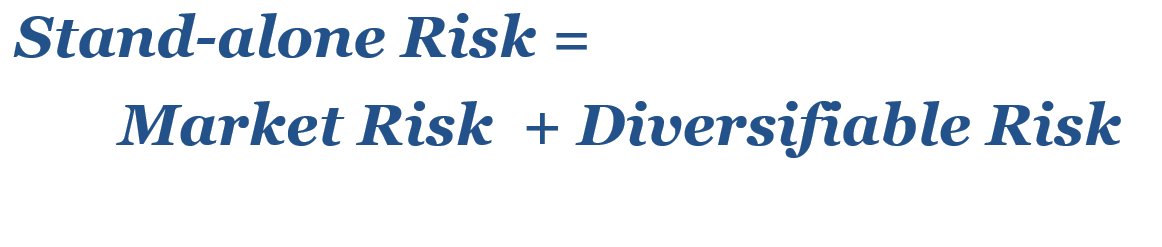

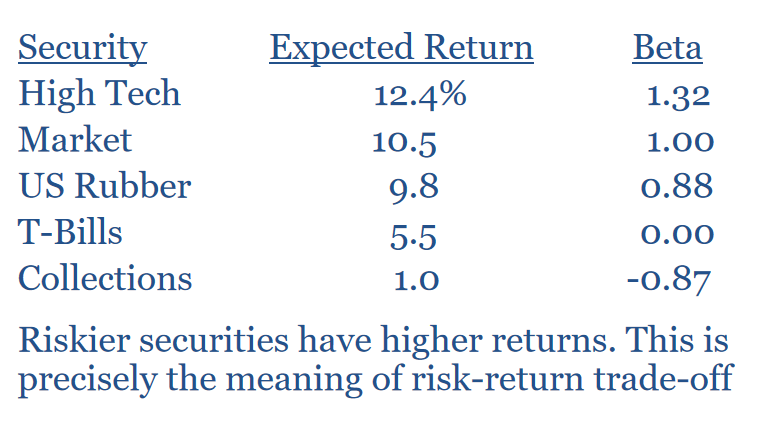

Risk

Beta

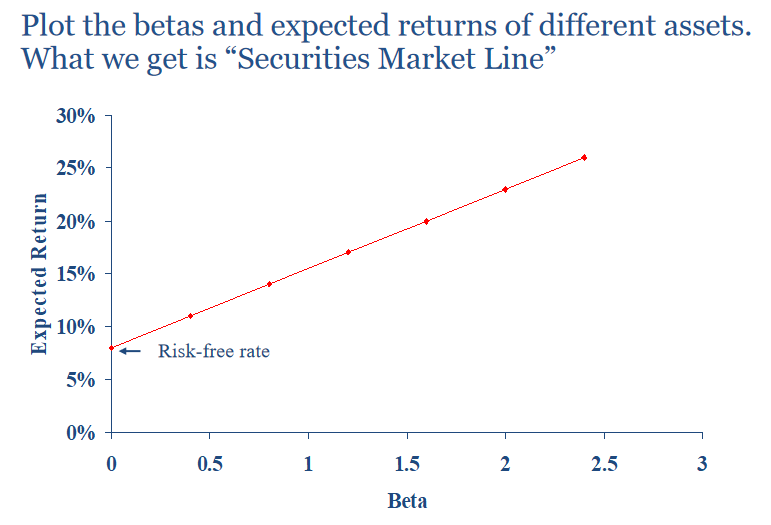

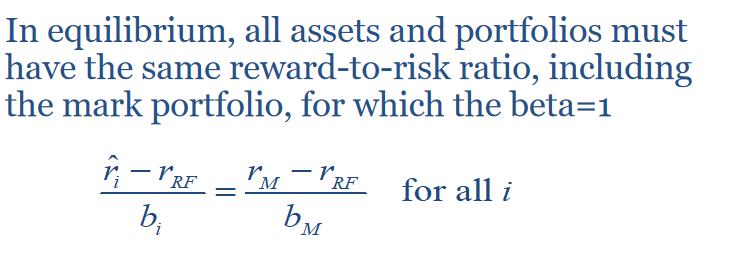

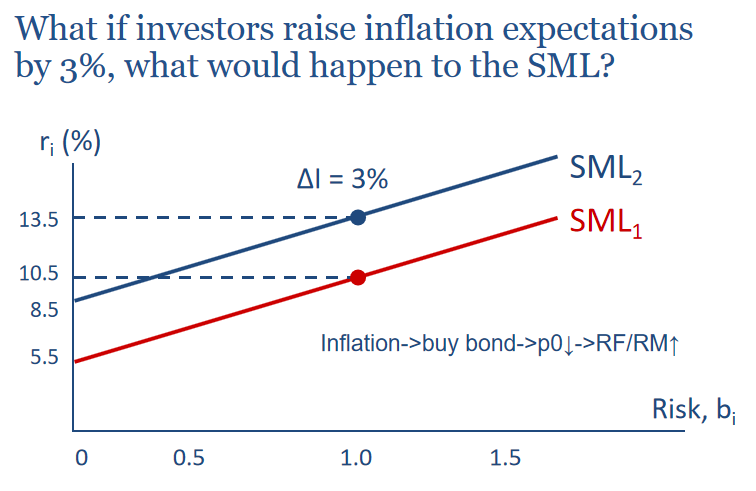

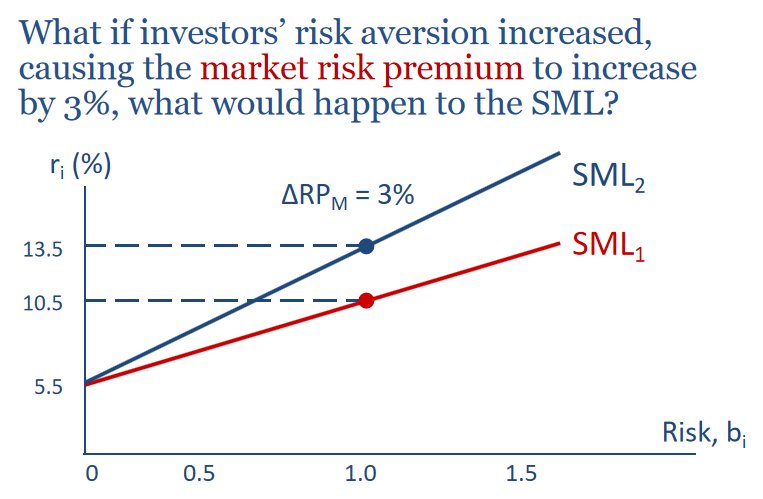

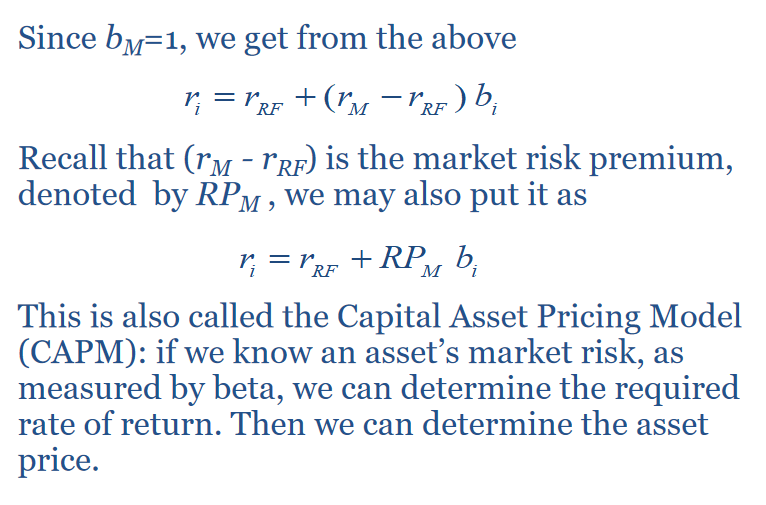

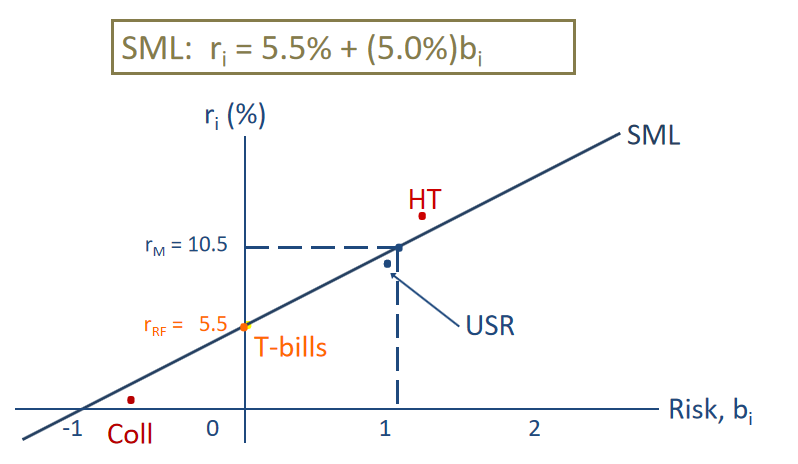

Securities Market Line

CAPM

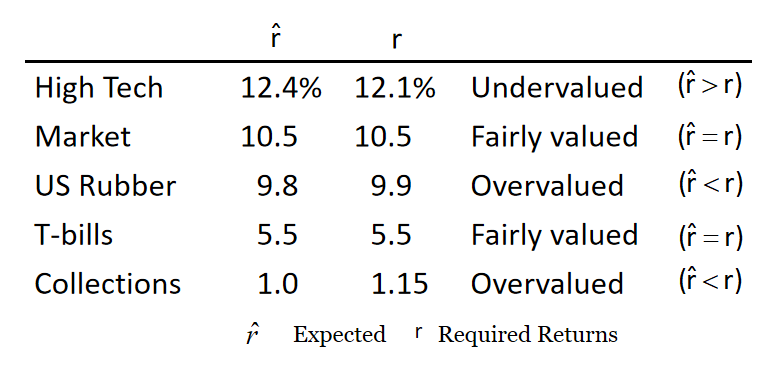

Over/Undervalued

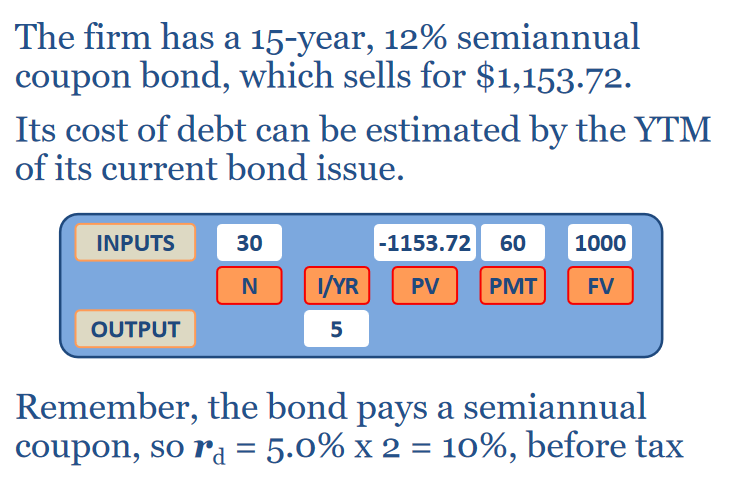

Lecture7-chp 11

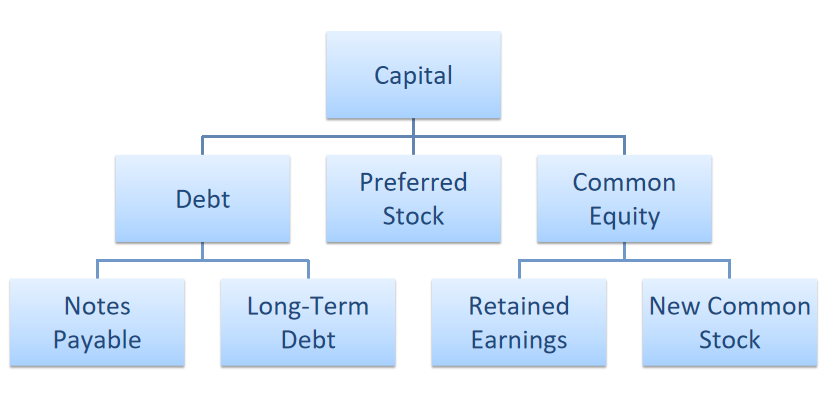

capital structure

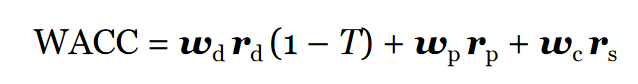

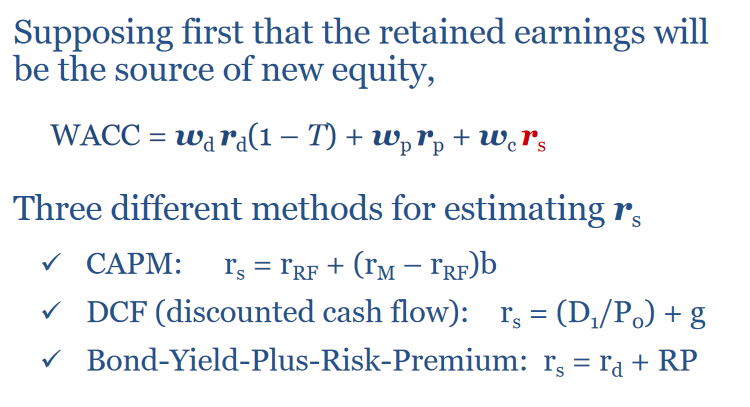

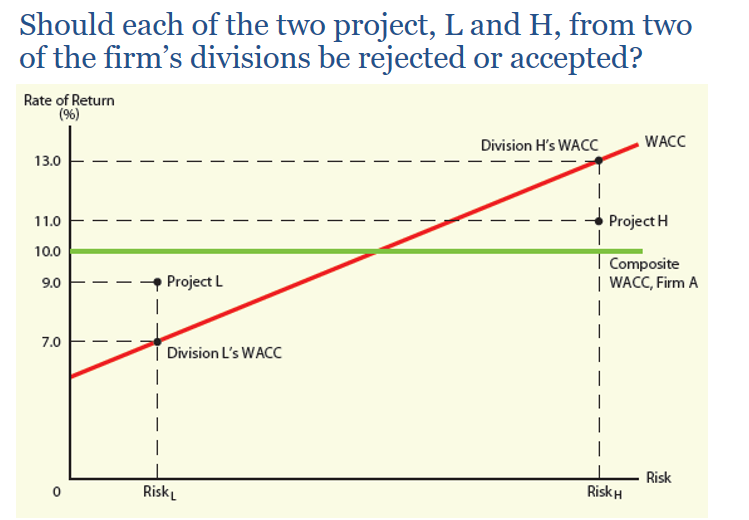

Weighted Average of Capital

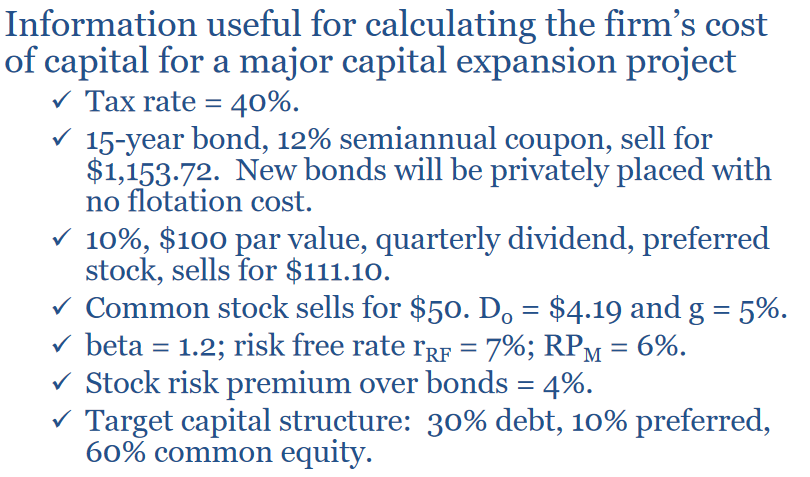

RD

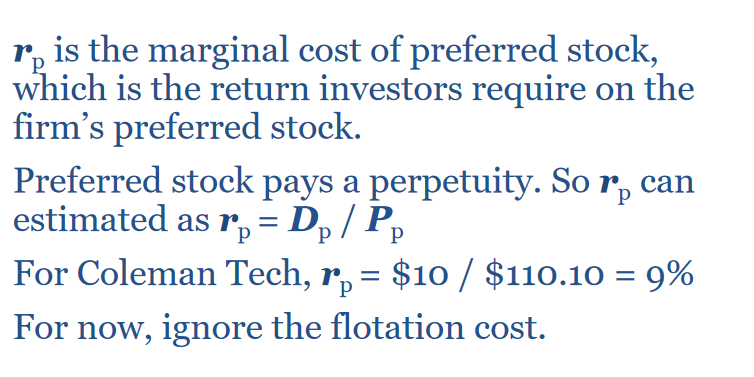

RP

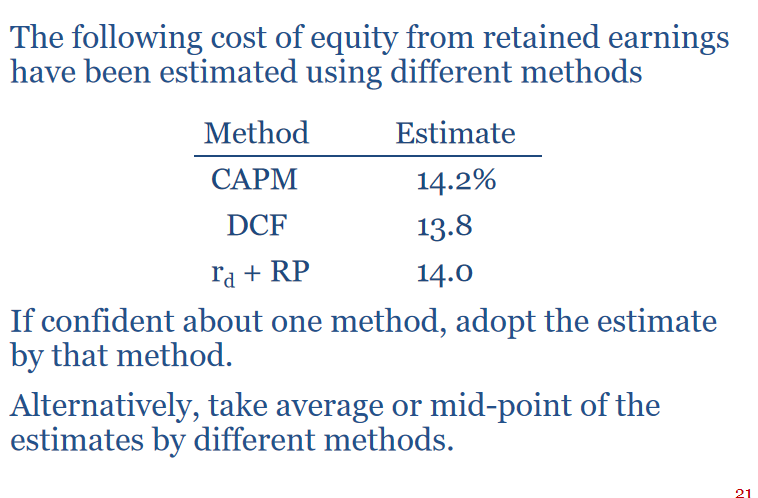

RS

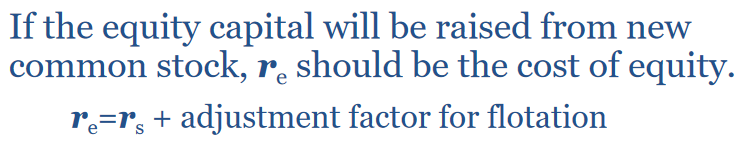

Flotation Costs

- only the newly issued common stock

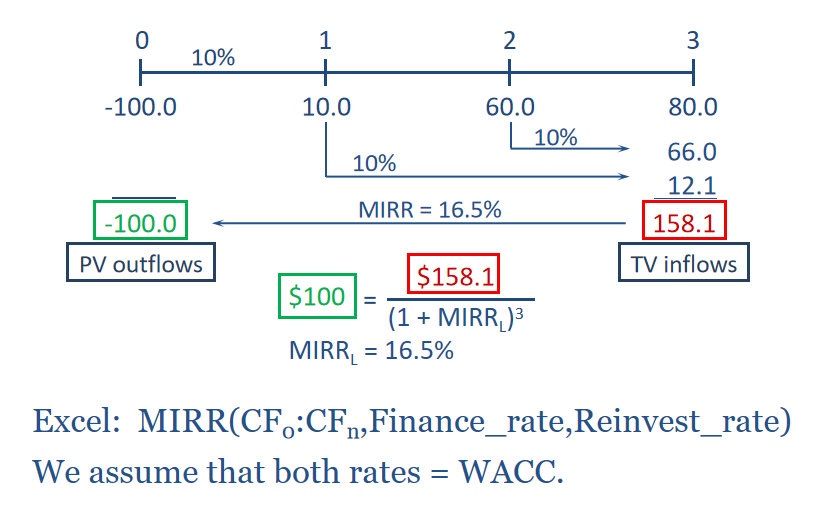

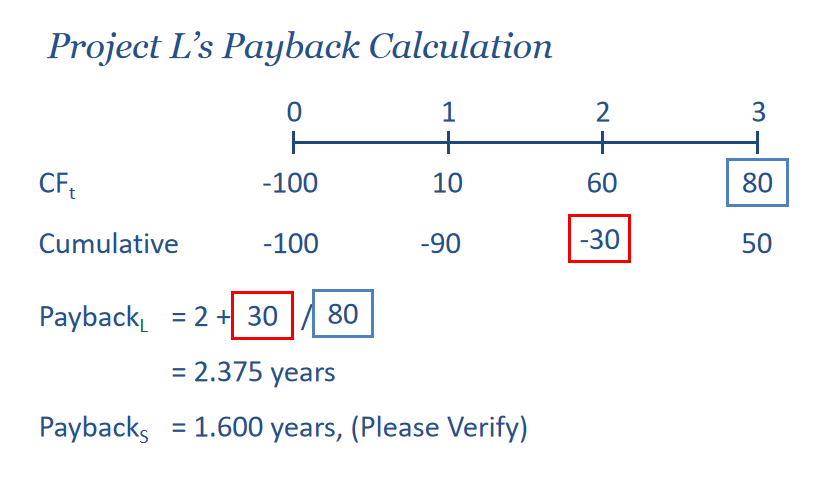

Lecture8-chp 12

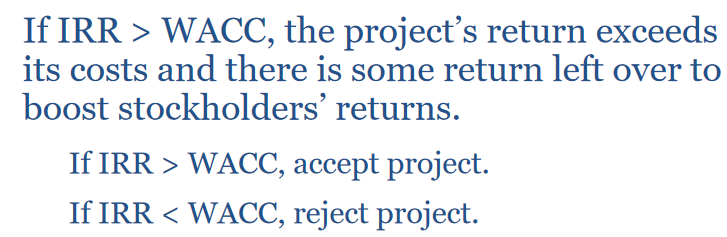

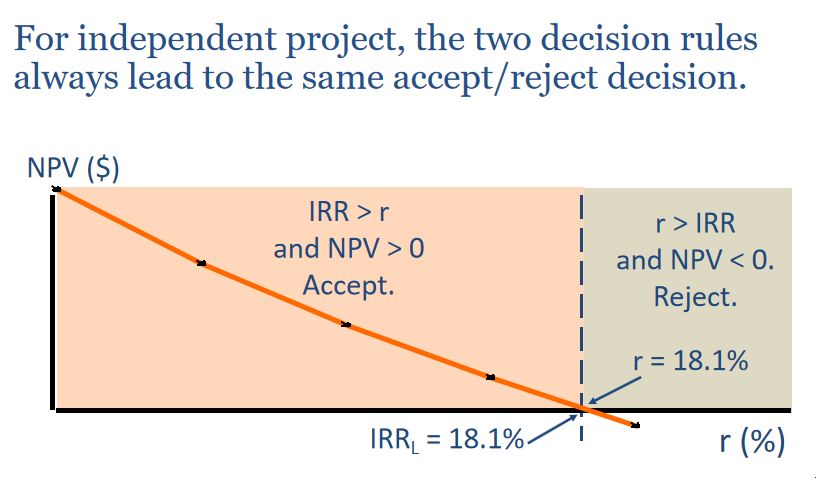

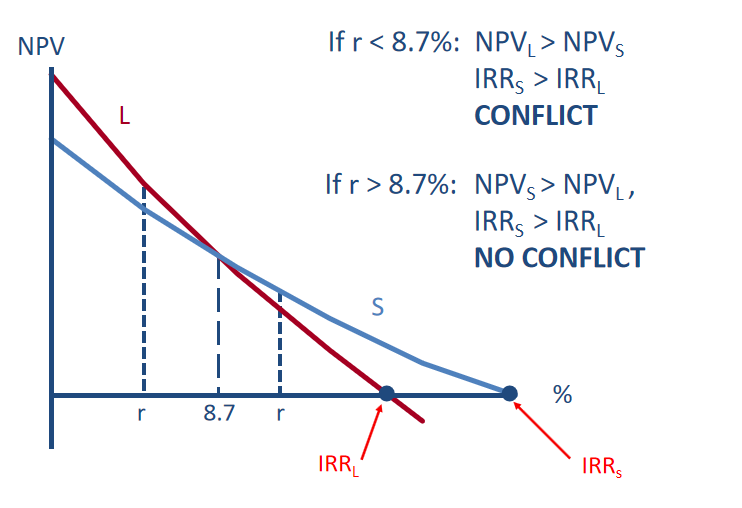

IRR

MIRR

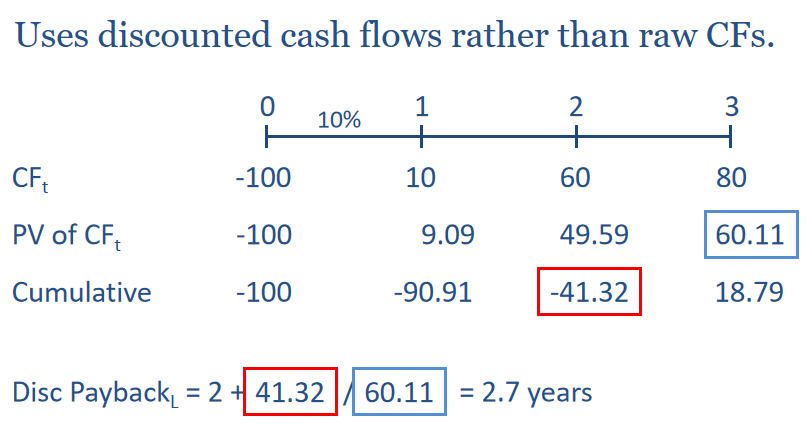

Payback Period

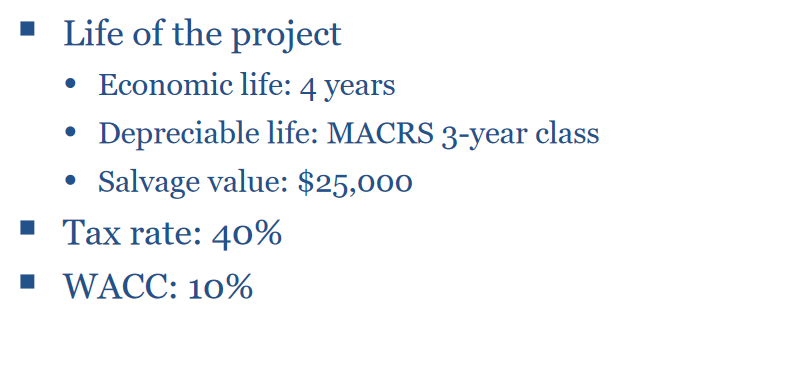

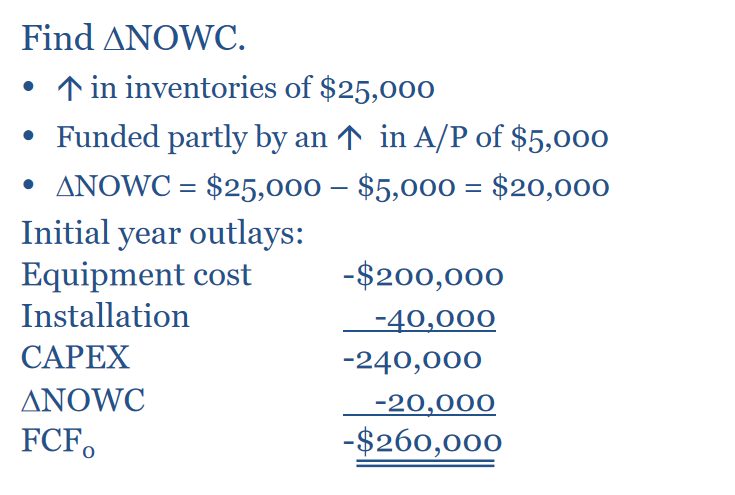

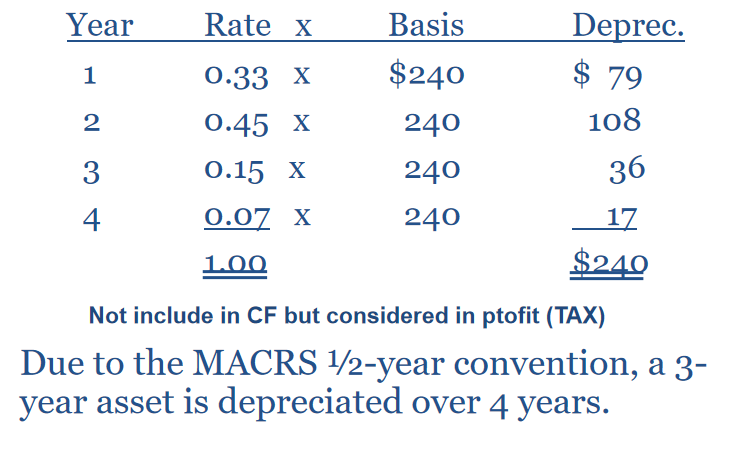

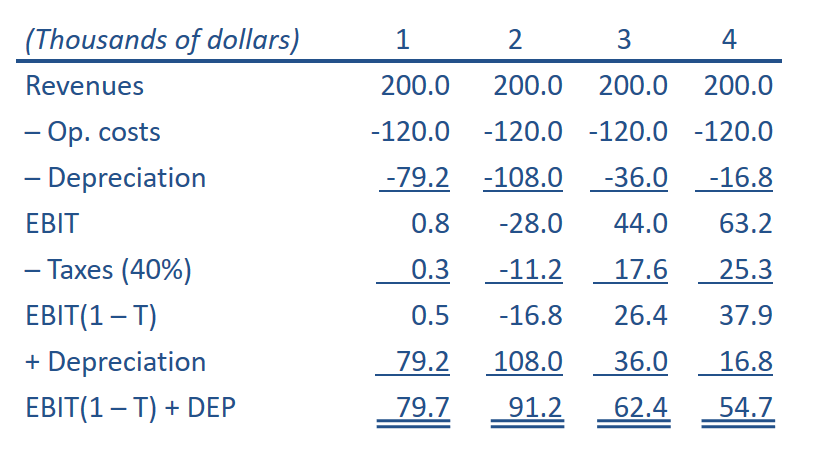

Lecture9-chp 13

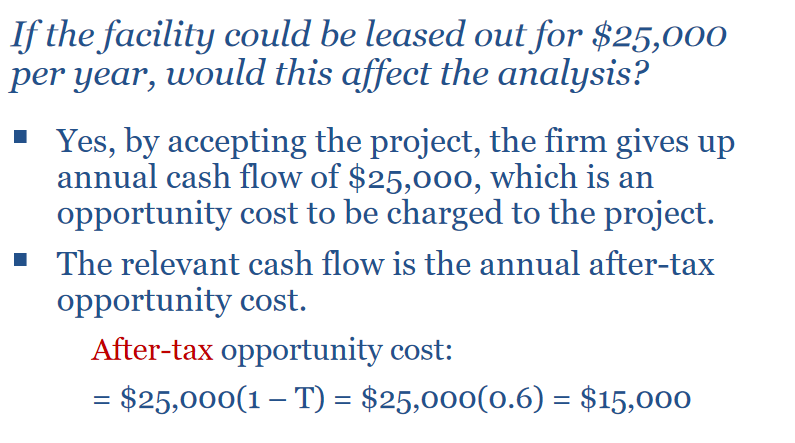

Relevant Cash Flows

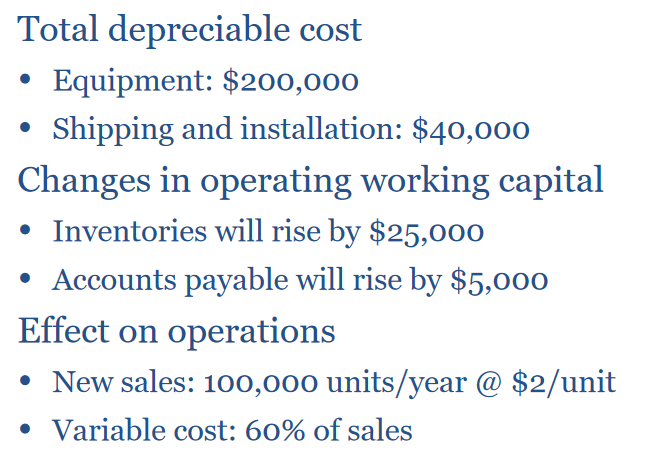

Initial

Anual

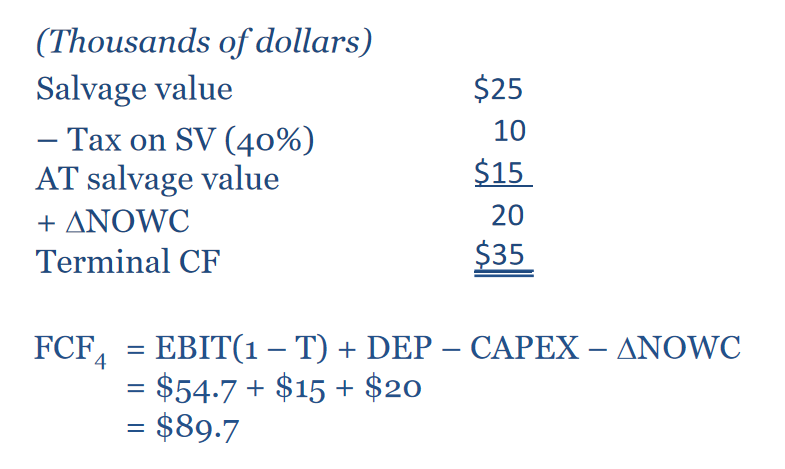

End

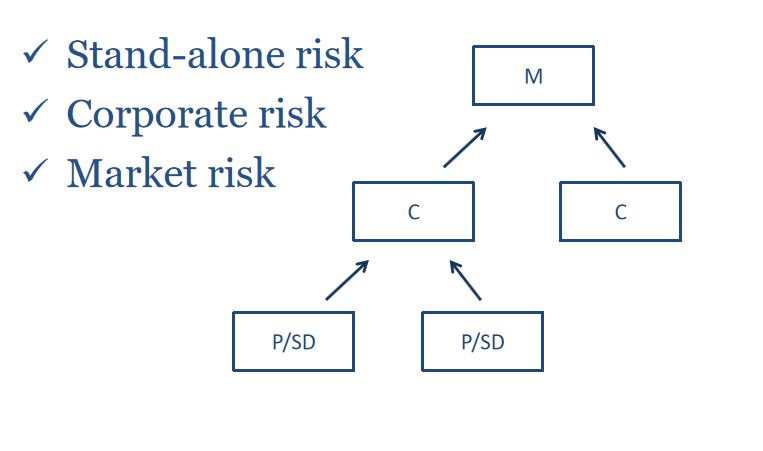

Three Types Risk

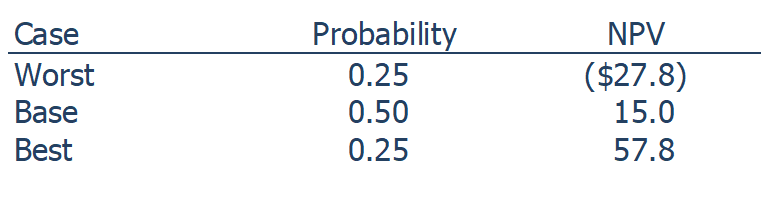

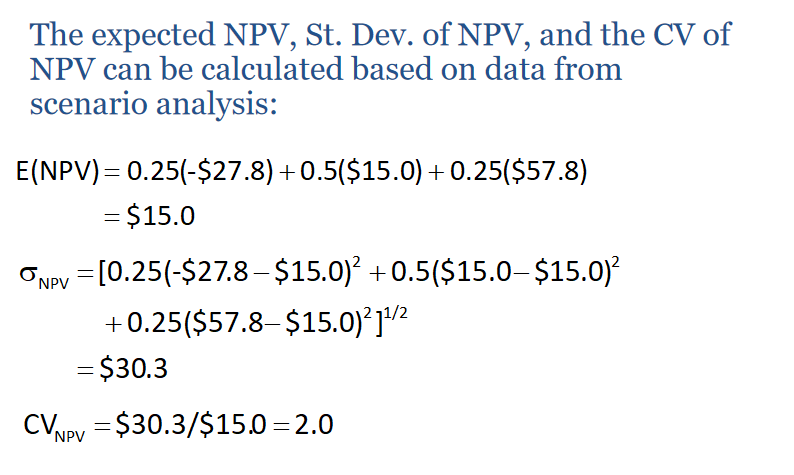

Scenario Analysis

Lecture10-chp17

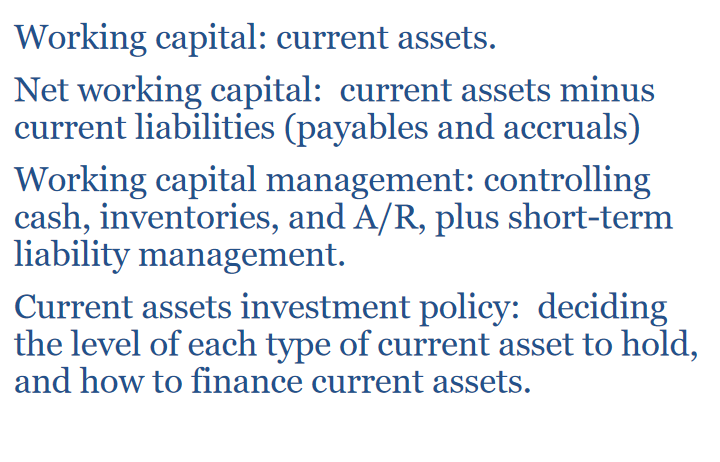

Three type of Working Capital

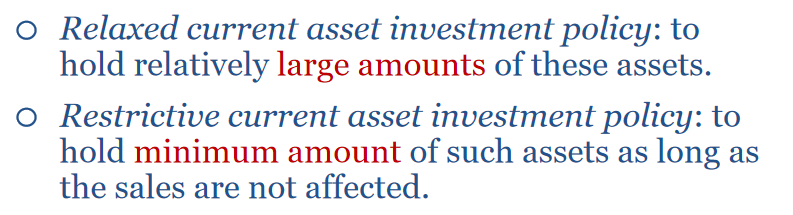

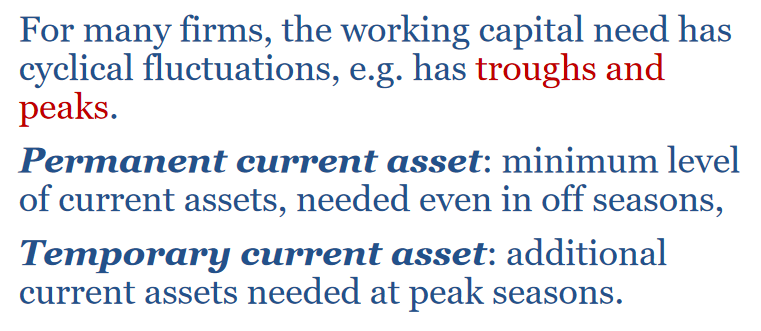

Two type of Current Assets

- A = E + L

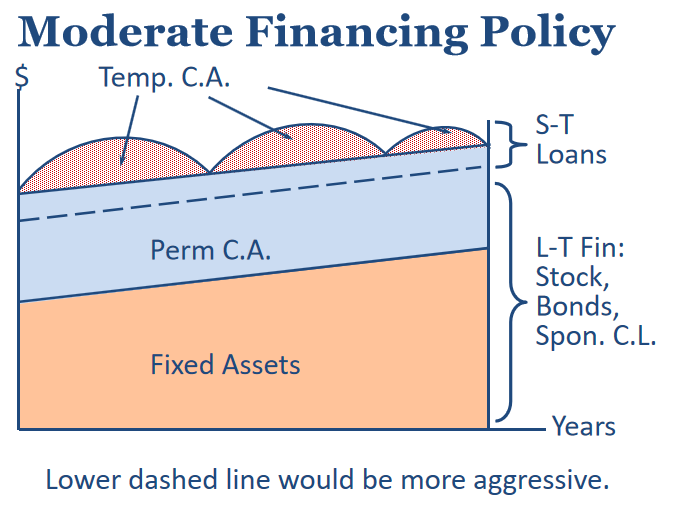

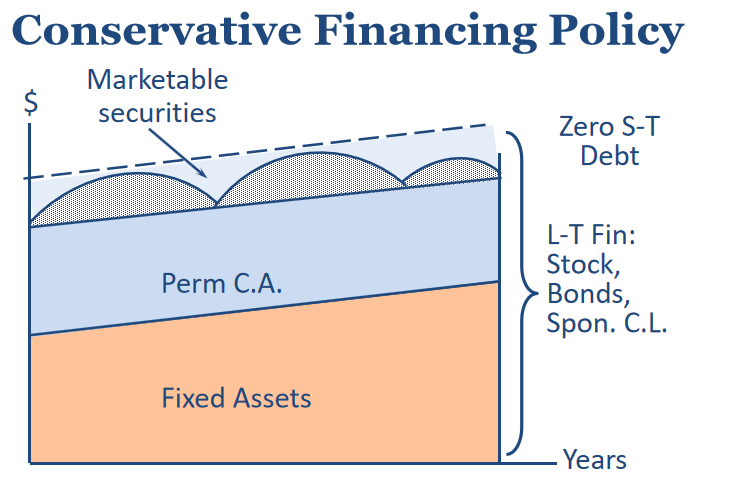

Maturity Matching

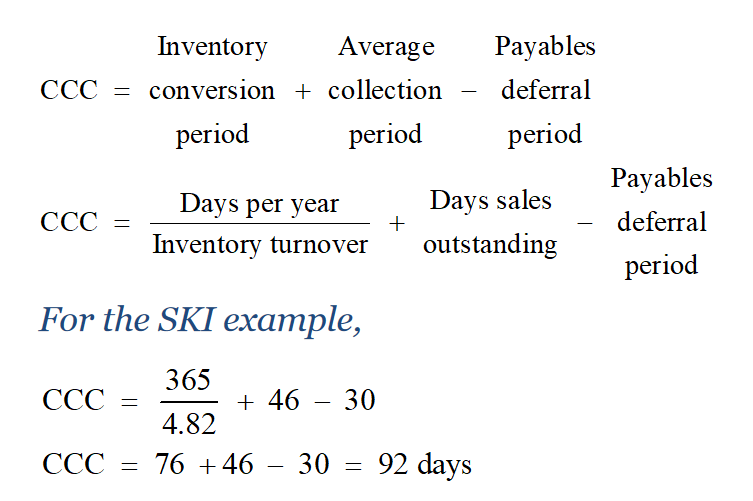

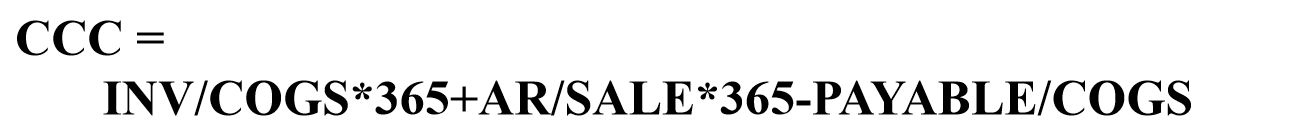

Cash Conversion Cycle

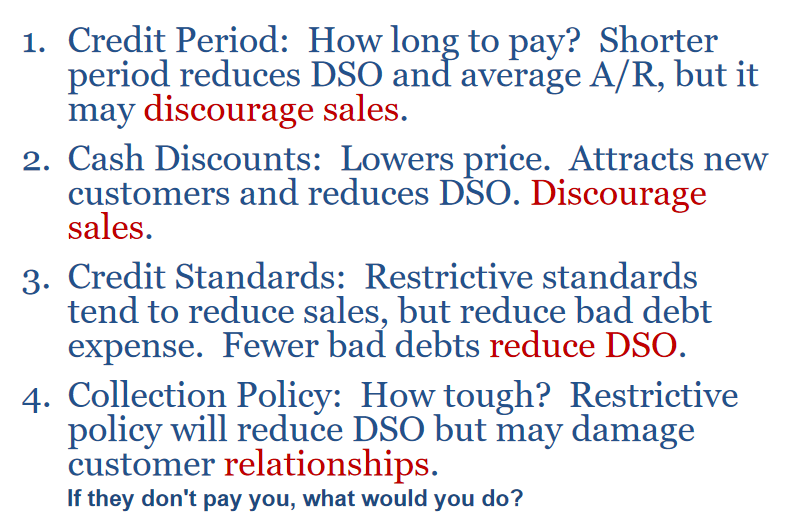

Credit Policy

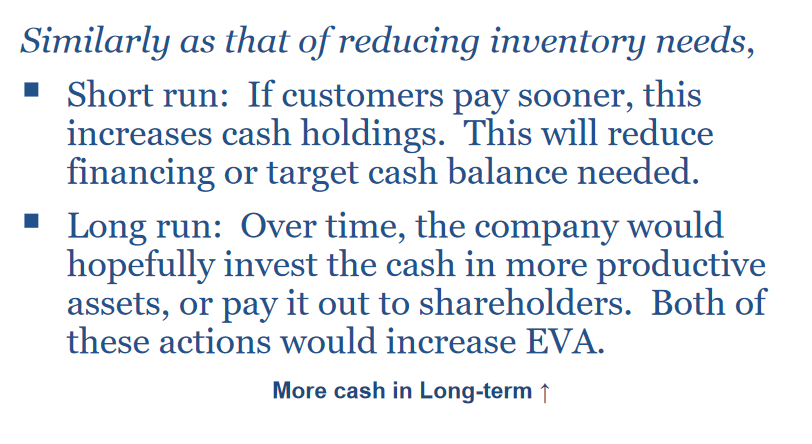

Effects of Reducing DSO

【笔记】财务管理笔记

http://achlier.github.io/2022/09/28/财务管理笔记/